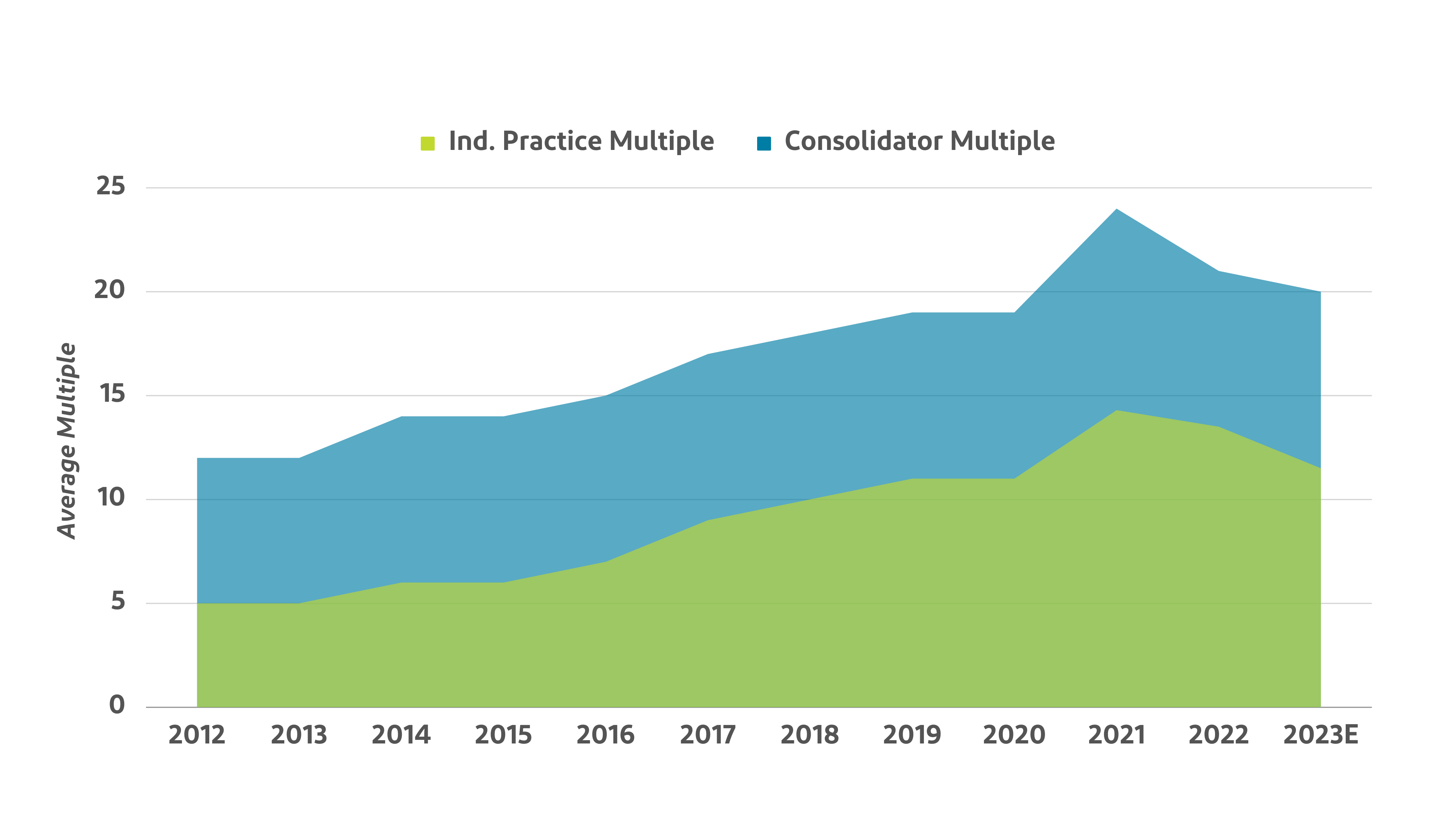

It seems like every day we’re hearing of another veterinary practice acquisition, and for good reason: valuations hit unprecedented highs in late 2021 and early 2022 at 12-18x EBITDA or Profits and sellers were taking advantage. Starting in Q2 2022, we saw valuations start to soften, and by the first half of 2023, values remain above pre-pandemic levels at 8-13x EBITDA or Profits, which is still attractive especially considering economic conditions. When you consider pandemic fatigue and the continued recruiting challenges for DVMs and non-DVM staff, you understand the forces that are driving practice owners to sell.

Valuations

The major driver of high transaction activity has been the high valuations for veterinary practices. So why did valuations for individual practices rise to such heights? It’s directly correlated to the pricing that private equity firms are paying for each consolidator when they sell.

From 2011 to 2013, when there were 8 to 10 consolidators, the consolidators would sell for approximately 12x profits or EBITDA. In late 2021 and early 2022, consolidators sold for double that amount at 22 to 25x profit. Meaning, a consolidator in 2012 with $30 million of profit would have sold for around $360 million. In late 2021? That same consolidator would sell for more than $700 million. Today, it is unclear where that consolidator would sell because with interest rates rising so much so quickly, the recapitalization or sale market for consolidators has been ‘frozen’ since Spring 2022 – there have been no significant sales of a consolidator since summer 2022.

On the chart below, you can see the clear relationship between practice prices and consolidator prices. In 2012, individual practices sold for 5-6x profits or EBITDA. In the second half of 2021, Ackerman Group saw average multiples approaching 15x and they have declined in 2022 and early 2023.

Individual Practice Multiples vs. Consolidator Multiples

The simple answer as to why there continues to be a ‘rush to exit’ among veterinary practice owners is because of the high valuations being paid. The question is, will these valuations last?

Why the High Valuations?

High valuations are driven by two overriding forces: the veterinary industry’s appeal and current macroeconomic conditions.

The attractiveness of the veterinary industry can be summarized by these key factors:

- The human-animal bond is growing strong

- Our industry is recession and pandemic-resistant, showing quality performance relative to other businesses in challenging times

- Solid historical growth rates of four to five percent, the pandemic’s spike of 8-12 percent growth, with a good outlook on future growth rates in 2023 and beyond.

- Pricing power, where pet owners are already willing to pay for the healthcare of their pets

Macroeconomic conditions, the second force impacting valuations, affect prices as a result of the following factors:

- Record low-interest rates during the past decade, and during the pandemic in particular where rates were near 0%, making capital cheap for practice buyers

- Stable economic conditions and slow but steady economic growth

- An abundance of investment capital, and many investors finding our resilient industry to place their funds

While the convergence of industry and macro-economic forces brought valuations to record levels in the second half of 2021, in early 2022 we clearly see the changes in the macroeconomic environment bringing valuations down from their unprecedented highs. The Federal Reserve has pushed Interest rates to 5% in 2023, up from 0% in 2021, inflation hit record levels in 2022 and is starting to abate in 2023 due to the interest rate increases, and the war in Ukraine continues on. All these factors have caused growth stocks to tumble over the past 12-15 months. As a result, valuations in the veterinary industry have softened from the unprecedented highs. It should be noted that valuations in 2022 and 2023 across all industries have fallen, with the stock market down ~20% from its early 2022 highs due to higher interest rates and high inflation. Veterinary valuations are not alone in declining.

But worry not — there are still plenty of buyers out there and demand remains strong, however, pricing is lower from its all-time high in 2021 but as of Q2 2023, it remains at or above pre-pandemic levels.