The veterinary become highly appealing to investors due to its consistent growth, strong human-animal bonds, and resilience even during economic downturns. Over the last twelve years, the number of veterinary practice consolidators has skyrocketed—from only about 10 corporate groups buying up practices in the early 2010s to more than 35 today and counting. However, post-COVID, the market has changed with slower growth. A question remains: is this slowdown in growth a transitory shift that will revert to historical growth rates, or has there been a fundamental industry change? Time will tell.

What’s Caused Major Industry Growth? Adoption Trends & More

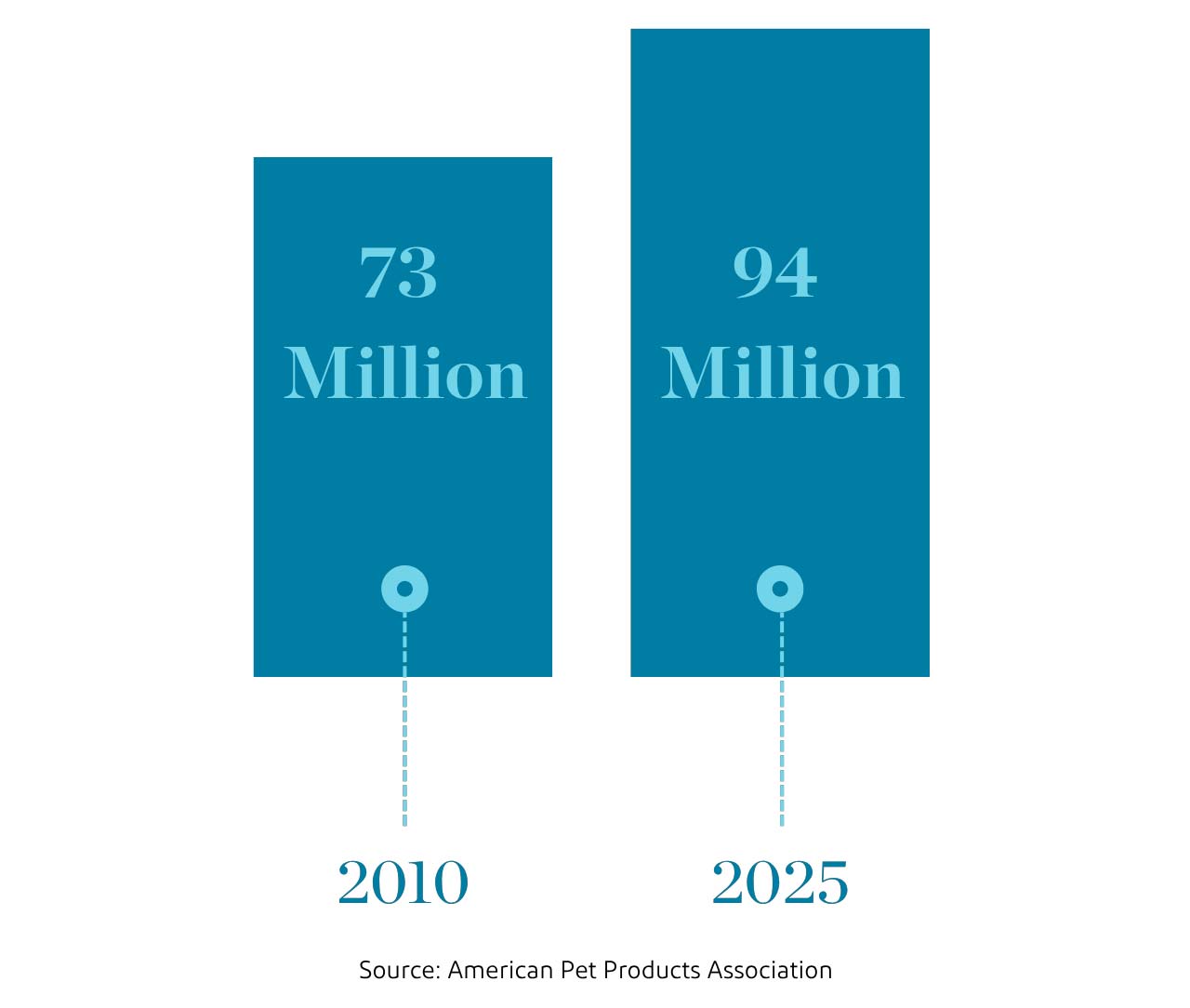

For starters, the deepening relationship between humans and their pets has played heavily into the vet industry’s growth. Pets are increasingly considered part of the family, leading to higher spending on their care and well-being. More importantly, the trends of who is adopting persist, with:

- Millennials increasingly adopting pets before they have children, and more of them adopting while still single

- Baby Boomers adopting pets as they become empty nesters

- Families continuing to adopt pets

In 2020 and 2021, it seemed like everyone added pets to their families. The mainstream media popularized this idea of a massive bump in adoptions during the COVID-19 pandemic, although data from shelters did not fully support this narrative. Shelter data shows that 2020 and 2021 saw no material increase in adoptions because of lack of availability of pets. However, there was likely an uptick in adoptions from breeders, who were able to have more newborns over those two years to meet the high demand.

Number of U.S. Households That Owns Pets

Under the Hood: Socioeconomic Shifts in Pet Ownership

During the pandemic, higher-income households were more likely to adopt pets. White-collar workers, working from home, took the opportunity to bring new pets into their families, leading to increased demand for veterinary services.

- Lower-income families faced more income insecurity, making pet adoption less feasible.

- Higher-income adopters are more likely to invest in regular veterinary care, boosting clinic visits and revenue.

Please note: This analysis is more nuanced and is based on anecdotal reports on ‘COVID’-adoption demographics. It has not yet been fully verified by data but is intuitively reasonable to explain the rapid growth in demand for veterinary services during the pandemic.

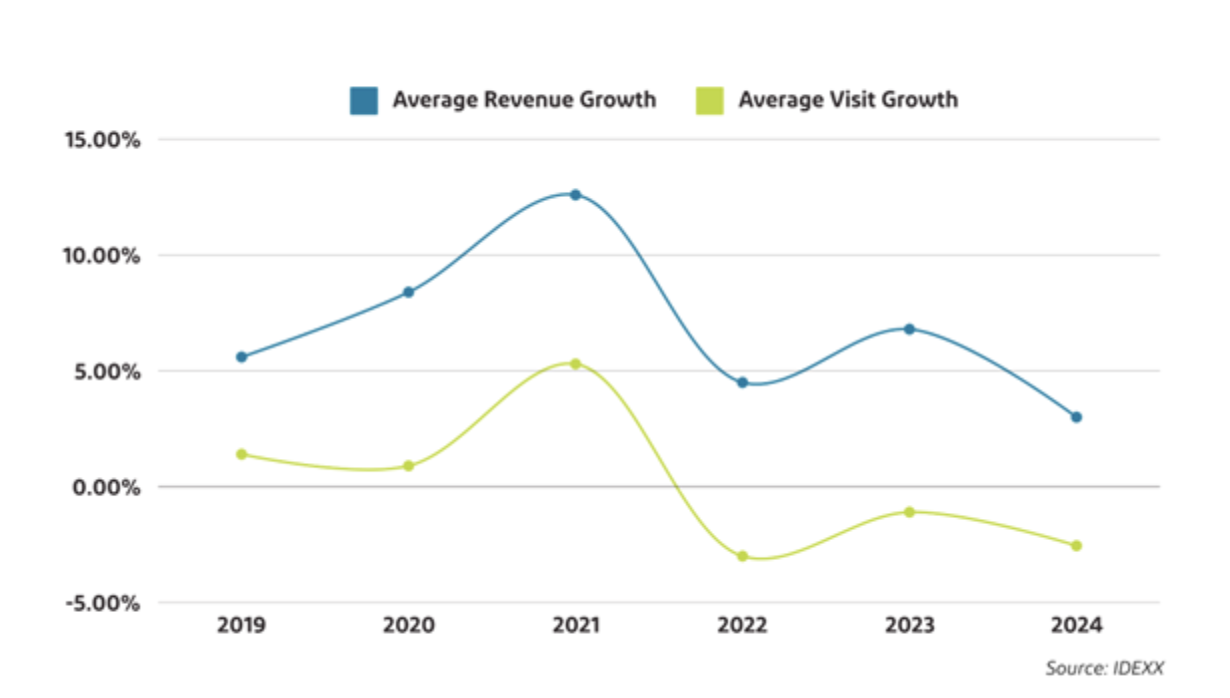

New Clients, More Visits, More Growth at Veterinary Practices

We saw more pets visit the vet in 2020 and 2021. Historically, 25 to 30 percent of pets did not regularly visit a veterinarian for care. Our hypothesis is that during the pandemic, higher-income families adopted, resulting in a smaller percentage of pets not receiving veterinary care. We believe that the growth in new client visits and how busy many practices were is likely due to this socioeconomic shift in adoptions as well as from pet owners working from and being able to more rapidly respond to issues with their furry loved ones.

But this trend has not seemed to play out post-COVID in 2022 to 2025. We have seen visit growth decline materially for 14 straight quarters and visits have declined over 2% for each of 2022, 2023 and 2024 and likely 2025 —a disturbing trend regarding the health of the industry.

The veterinary space had historically seen revenue growth of four to six percent, with a flattening during the 2008-2010 recession. During this steady growth period, invoices or visits grew consistently from 0.5% to 1.5%, a predictable expansion of the market. That growth accelerated exponentially in 2020/21, with more than 11 percent growth in the industry. While 2022 remained strong it was primarily driven by pricing (visits declined 3% in 2022). The challenge is the decline in visits has continued in 2023,2024 and 2025.

Veterinary Growth Outpacing the National Economy

When compared to the broader economy, the veterinary industry had consistently outperformed; the space has grown 2-3x faster than the U.S. economy during the 2010s. This long-term growth drove investor interest throughout the decade and was further enhanced when factoring in pandemic performance.

- 2010s Growth: The U.S. GDP grew at an average of 2% annually, while the veterinary industry grew at 4% to 5%.

- Pandemic Surge: In 2020 and 2021, the industry experienced growth rates of 7% to 12%, compared to the GDP’s 2% to 4%.

- Today: The industry continues to grow revenue, but visits have been declining, and the growth is now at the same rate or slightly higher than the economy. This unhealthy “Same Store” invoice growth creates some concerns and challenges the potential ROI for investors.

Pandemic Performance: Veterinary vs. Human Healthcare

The veterinary industry showed it was recession-resistant by staying open and maintaining steady revenue during the pandemic, even when many human healthcare services faced closures and financial struggles. Pets could be seen through drop offs during COVID while human health care requires in-person contact.

Over many decades of performance, veterinary and human healthcare services sectors have been widely viewed as recession-resistant businesses that perform well through good and bad times. In 2020 and 2021, we saw for ourselves that the veterinary industry is also pandemic-resistant: veterinary hospitals remained open. Most human healthcare services businesses, on the other hand, shut down intermittently, even experiencing a few months where they posted zero revenue. From March to June of 2020, human healthcare services (from dental, to physical therapy, to dermatologists and optometrists) had to shut down in some capacity, taking massive hits to their bottom line. The return to normal happened over many months, not quickly.

What makes Rich Lester an expert on this topic?

– Founder + CEO of a corporate buyer

– 16+ years in the veterinary space

– Dozens of practice transactions

Veterinary Practices Benefitting from Pricing Power

With a veterinarian shortage, strong demand for veterinary services, and rising wages with the spike in inflation, veterinary hospitals were able to raise prices without impacting short-term demand materially during COVID-19. Not only that, but unlike human healthcare, veterinary is not at the mercy of third-party payors or Medicare / Medicaid reimbursement rates, which allows the veterinary industry to adjust prices more freely.

Pre-pandemic, veterinary industry growth was aided by regular price increases, and there was commentary that service costs were pricing some pet owners out of the market.

But the pandemic and staff shortages have led all veterinary hospitals, particularly specialty hospitals, to push prices even more. The impact on demand was minimal through the end of the pandemic. Think about it: When a practice has a two or three week wait for an appointment, raising prices by five percent or more is a reasonable strategy when struggling to hire staff to meet the demand.

Again, the comparison of the veterinary industry to human healthcare is instructive in context. Raising prices at dental practices, physical therapy centers, and medical practices are much more complex with payor contracts and government reimbursement rates in the mix. This makes the veterinary industry significantly more flexible on pricing on a comparative basis and more interesting to investors!

However, all the pricing power that veterinarians and corporate practice owners exercised during the pandemic seems to be leading to the current struggles. With the three-and a half consecutive years of negative 2%+ invoice growth – pet owners are sending a message that pricing is too high.

Veterinary: A Resilient Market for Investors

Investors have been drawn to the veterinary industry for several reasons: consistent growth, high demand, pricing flexibility, and resilience to economic downturns. The question in late 2025 now becomes this: Will those dynamics change? And will consistent growth (invoices in particular) return in 2026 or 2027?

Practice sale valuations hit their peak in 2021 and early 2022, then softened after mid-2022. But despite these poor industry fundamentals, valuations are on the rise again in 2024 and continuing into 2025. This is happening as interest rates went down slightly in this period and competition among consolidators stays strong. While we’re not quite back to the highs of 2021 (12-18x EBITDA multiples), the EBITDA multiple range of 8-13x from late 2022 to mid-2024 is now climbing to 8-14.5x in 2025.

At Ackerman Group, we’re excited to see what the future holds for this formidable space and look forward to helping practice owners make the most of it. Want to see what your practice is worth in today’s market? We offer complimentary practice valuations to qualifying veterinary practices.

See what your practice is worth in today’s market, get your complimentary valuation from Ackerman Group.