Veterinary Practice Sales

Q2 Market Update

August 2025

Backed by extensive research and data

exclusively from Ackerman Group

To our Readers

Rich Lester

(207) 450-8800

rlester@ackerman-group.com

Gary Ackerman

(804) 334-7387

Ackerman Group is proud to bring you this latest edition of our quarterly research report. Backed by our extensive practice sales dataset and our team’s decades of experience advising on transactions, this report is intended to provide veterinary practice owners, as well as the broader profession, with insights and analyses found nowhere else in the industry.

While not a detailed guide to selling your hospital, this report highlights real-time trends we are observing in the market to help position you and our clients for the best outcomes possible during a sale process.

Should you find yourself thinking about selling your practice and wish to take advantage of our unmatched market experience and extensive dataset, Ackerman Group is ready to assist you from beginning to end. Hundreds of veterinarians have entrusted us with advising them on the sales of their practices, and during the increasingly important time post-sale, when incremental value is frequently earned in transactions today. Our goal is to align with your personal, professional, and financial goals.

We wish you and your practice continued success. Don’t hesitate to reach out with your questions!

Rich Lester

Chief Executive Officer,

Ackerman Group

Gary Ackerman

Founder, and CEO Emeritus,

Ackerman Group

Executive Summary

Veterinary valuations continued to rise, and demand from buyers remains robust despite industry pressures and an uncertain economy.

The strength of the veterinary market is clear. Specifically:

The Highlights:

- Purchase Price Multiples climbed even higher for General Practice (GP) hospital transactions that closed in the first half of 2025 (1H25), exceeding the increasing levels from 2H24. The weighted average GP multiple reached 12.5x.

- Cash at Closing on Ackerman Group transactions declined slightly to 64% of total consideration in 1H25; reasonable levels given high interest rates and high valuation multiples.

- Many Active Buyers are driving the market, as Ackerman Group has sold 29 hospitals in the United States to 13 different buyers in 1H25.

- Invoice Growth remains a major industry headwind. Invoice growth has declined for three straight years—2022, 2023 and 2024—with invoices down over 2% each year. Q1 2025 was similar, and we expect the same results in Q2 2025.

The U.S. and world economy remains uncertain, with tariffs and ongoing wars in the Middle East and Ukraine creating a challenging investment environment for most businesses.

We will start our second-quarter review with a look at the U.S. economy.

We will then examine veterinary industry trends and the continued robust market for sellers of veterinary practices.

Ackerman Group at a Glance

The Veterinary Professionals Leading Broker

$2.1 B+

In combined value of veterinary practices brokered by our team since 2020.

265+

Veterinarians we have assisted with the sale of their veterinary practices.

75+

Years of collective experience among our Senior Partners in the veterinary industry.

The Current State of the U.S. Economy

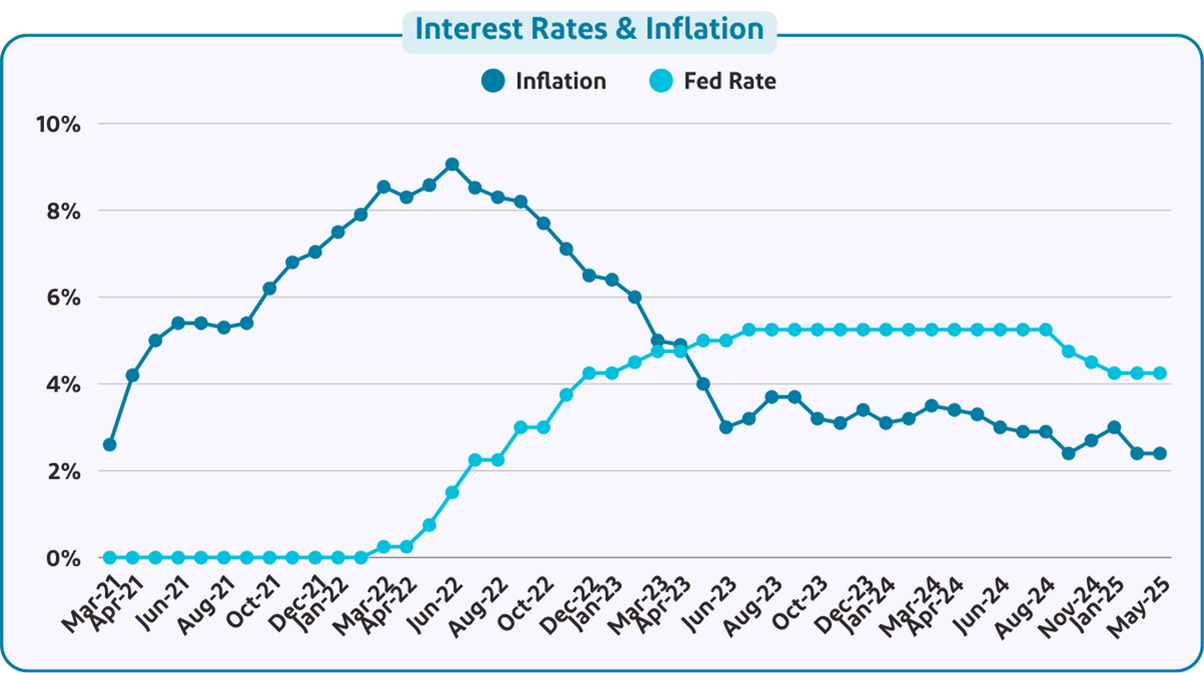

Despite the President’s tariffs, inflation declined to 2.4% in May 2025, down from 3.0% in January. Economists warn that it takes a few months for the effects of tariffs to appear in inflation data, especially since businesses front-loaded inventory purchases in early 2025 due to the threat of tariffs. It will be an interesting summer to watch inflation trends.

The chart below shows that monetary policy (raising interest rates) worked to ease inflation post-COVID. The Federal Reserve recently made it clear that it is holding off on further interest rate cuts until it sees the full impact of tariffs. The Fed’s inaction on lowering interest rates is raising the ire of President Trump.

The Current State of the U.S. Economy, cont.

The Trump Administration continues to execute on its campaign promises related to aggressive enforcement of immigration requirements, tariffs to support American manufacturers, shrinking the federal bureaucracy through DOGE, and implementing an America First foreign policy.

Amid so much activity, the slowing economy and declining consumer confidence are not receiving as much media attention. Q1 2025 saw a decline in economic growth, partially driven by businesses over-purchasing inventory in anticipation of tariffs. Q2 2025 is expected to see a rebound as inventories are sold off and replenished at a slower rate.

The U.S. economy is expected to remain uncertain through these choppy times. The veterinary market, which has historically outperformed the overall economy, will likely continue its trend of underperformance.

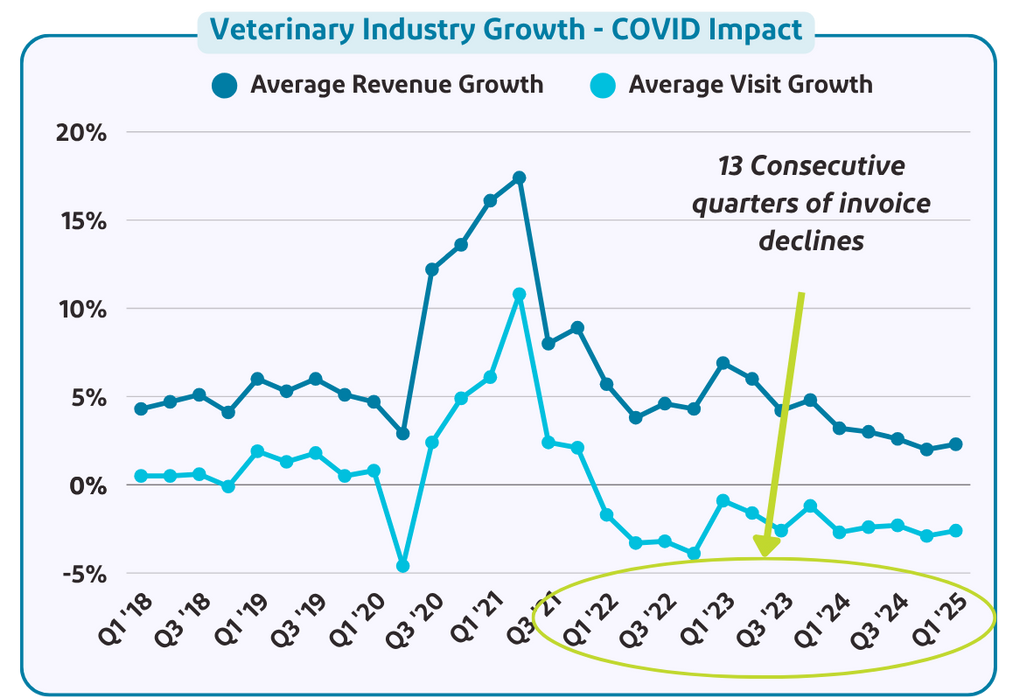

Negative Veterinary Industry Growth

The industry continues to face strong headwinds.

What is causing the decline?

- Practices raised prices aggressively in 2020 and 2021 when demand was insatiable, and these price increases have likely impacted clients’ willingness to visit.

- COVID puppies and kittens have become adults, which tend to visit clinics less frequently (until they become seniors).

- Economic uncertainty is making consumers more cautious.

Is the invoice decline a cyclical downturn that will revert to the predictable ~1% invoice growth of the 2010s?

It was the stable, predictable invoice growth of the 2010s that attracted massive amounts of investment capital into the industry and drove purchase prices for veterinary hospitals from pre-2016 levels of 4-6x EBITDA to today’s 8-15x EBITDA.

Our view is that a return to invoice growth is unlikely in 2025. This is because consumer confidence is low and a recession may occur. This is not a positive trend for the veterinary industry.

What does this mean for practice owners?

The concern is IF invoice growth is negative for a fourth year in a row (2025), investors may start to view it as a fundamental industry issue and not a cyclical correction. We believe investor sentiment could begin to shift, risking valuation declines.

However, the industry has remained resilient despite these headwinds, and we know investors are counting on above-average invoice growth starting in 2027-28, when COVID puppies and kittens become seniors (over 7 years old), likely requiring more frequent visits.

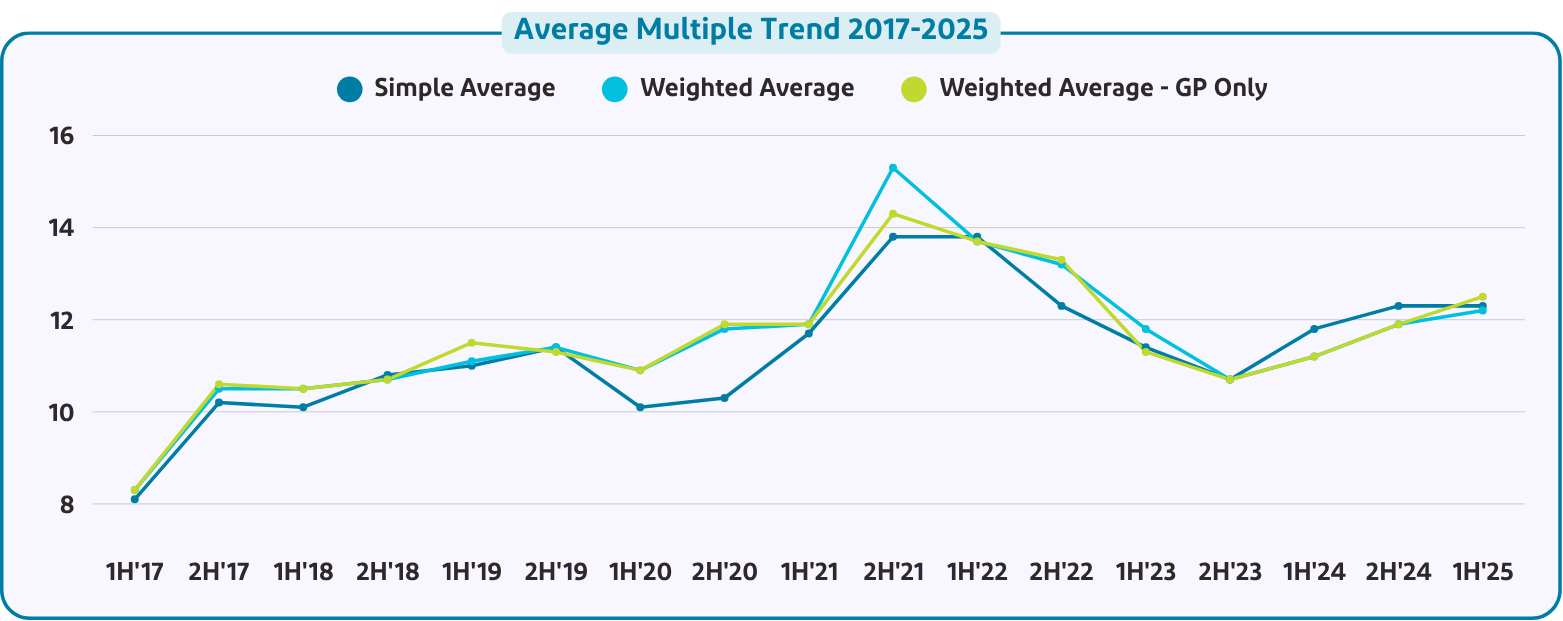

Despite Headwinds, Industry Valuations are Strong

Practice valuations continued to improve in the first half of 2025, a trend that began in 2024 (after the market bottomed in 2H23). Ackerman Group closed a number of larger deals, defined as over $750,000 of EBITDA in 2Q25, which helped drive the averages up from late 2024.

The economic and industry rationale for such high valuation’s is weak, but the chart below shows the positive valuation trend: a slight increase in 1H24, accelerated into 2H24, and stabilized in 1H25. Weighted average General Practice multiples for Ackerman Group deals now exceed 12x.

The weighted average of all deals (orange line) is lower than the GP-only average due to several sizable ER-only and single-specialty transactions that brought down the overall average. Note that specialty and ER transactions are seeing similar to slightly higher multiples compared to large GPs.

Four Strong Transaction Trends and Terms

1 Deal Volume

The Ackerman Team helped sell 29 hospitals in the U.S in the first six months of 2025 for a ‘headline’ value of over $251MM, or an average of $8.4M per location. In all of 2024, we sold 37 hospitals for $195MM, or $5.3M per location.

A few key points:

- We believe transaction volume hit a trough in 2024, with only 350 hospitals sold to corporate buyers. We expect 2025 to see between 400-500 hospital transactions.

- The average EBITDA of the 29 hospitals we sold in 2025 is $723,000, compared to only $451,000 last year. Larger hospitals are beginning to explore exit options and are being rewarded by the market’s insatiable desire for high-quality hospitals.

2 Bifurcated Market

Higher EBITDA practices are driving the overall increase in multiples. Buyer demand remains strong, and the number of quality sellers (4+ DVMs and at least $750,000 of EBITDA) is driving up the weighted average multiple, with offers in the 12-15x range.

Some smaller 2- and 2.5-DVM practices are facing more challenges in attracting interest than they were twelve months ago. Specifically, if a seller is in their mid-60s (or older) and/or located in a less-than- ideal geography, there is less buyer interest. Buyers now have more experience with the recruiting risks associated with certain types of smaller practices and better understand where they’ve had success and where they haven’t. They’re using that experience to guide what they are looking to buy. That said, there are still well-positioned smaller practices that are attracting strong valuations.

Smaller practices in good locations, with good buildings and younger owners (under 60), are seeing good valuations.

Four Strong Transaction Trends and Terms (cont.)

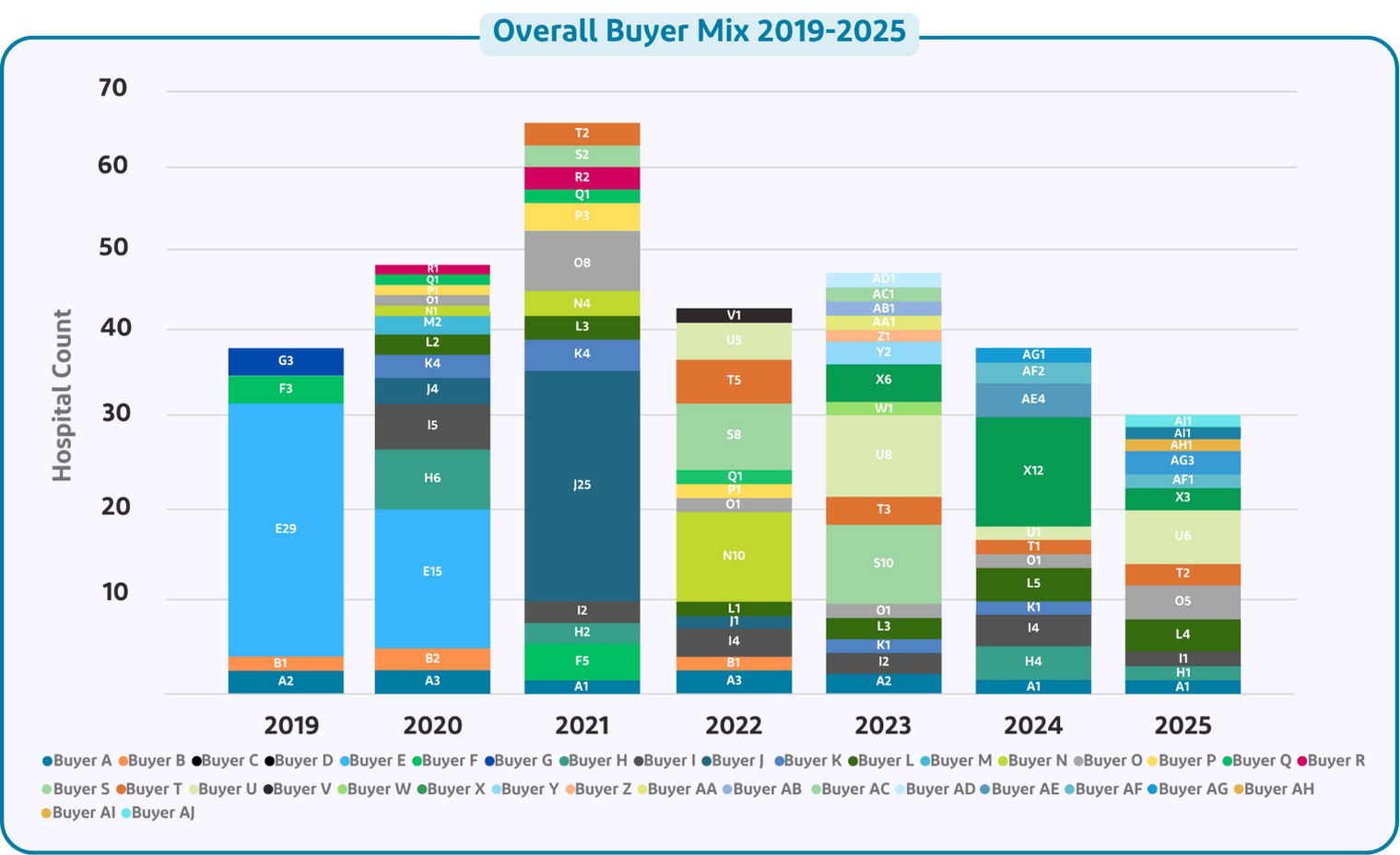

3 Buyer Diversity

From our perspective, the key market data point is the variety of buyers still active. Ackerman Group has closed deals with 13 different buyers for the 29 U.S hospitals we sold in 1H25 (the graph below includes one Canadian Hospital).

Veterinary hospital demand isn’t being driven by a few large buyers. Rather, a wide range of active buyers is sustaining high valuations. Smaller and mid-sized buyers are bidding aggressively for hospitals that fit their investment criteria.

Four Strong Transaction Trends and Terms (cont.)

4 Cash at Close

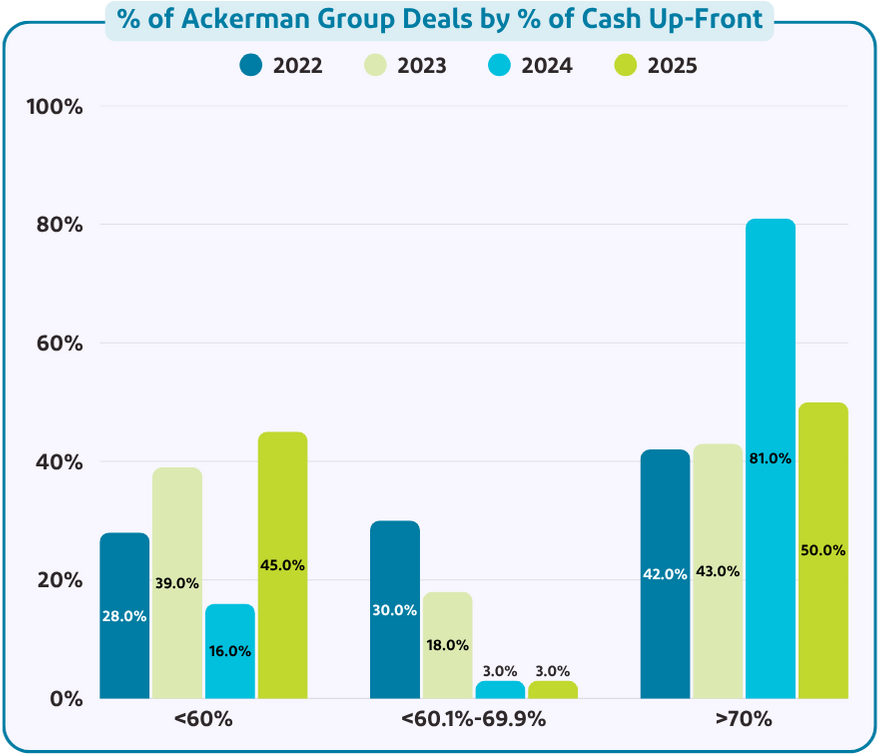

One of the most important transaction trends that we track is the percentage of cash at closing, which has slipped slightly from the peak 2024 levels when 81% of the hospitals received at least 70% cash up-front. In 1H25, this figure has dropped to 50%.

It appears that the reduction in cash is being offset in some deals by contingent payments and earnouts.

Buyers are looking to protect downside risk by including Notes or Earnouts that require maintaining current revenue or achieving incremental growth.

With invoice and revenue growth proving difficult in the first half of 2025, these evolving deal structure reflect broader industry trends.

The Dormant Recap Market Showed Signs of Life in Late 2024

The large veterinary consolidator recapitalization market (finding a new investor to buy out existing investors) had been dormant since mid-2022, when Vetcor and People, Pets & Vets merged. The merger of Southern Veterinary Partners (SVP) and Mission Veterinary Partners (MVP), which closed in December 2024, was the first large recapitalization in 2.5 years.

The SVP/MVP deal closed at a good valuation – 17-18x EBITDA. However, we are now over six months since that deal closed, and there have been no other successful recapitalizations. There are a number of mid-sized and large consolidators that are, or will be, looking for new investors, but the market is choppy.

For the individual practice owner, it is important to understand that as larger corporate groups look to recapitalize, they want to accelerate their growth by acquiring more hospitals. The rising multiples we have been seeing in the industry are being driven by the increased demand from consolidators that want to show growth before they recapitalize.

We will be carefully watching the trends in the recapitalization market, because if those deals happen at lower multiples, it could lead to lower multiples for individual hospitals. If the recapitalization market validates the SVP/MVP multiple, then we would expect the individual market to continue at the current valuation levels.

Real Owners. Real Opinions.

![]()

“By ourselves, we had previously received an offer from NVA that seemed low to us. With the sale, JV earnings, and earnouts achieved, we ended up making 17 million more than that initial offer. I know we hear comments about the commission rate on sales, but look what we achieved with it! We can absolutely state that the commission price was money well invested.”

![]()

“I’ve been in the banking world for almost 30 years, so I was familiar with the processes [of selling] and was fearful of what I was getting myself into. Ackerman Group made it more seamless than I anticipated.”

Summary

As an industry, we hope these positive valuation trends continue indefinitely!

Don’t forget: Before 2017, veterinary practice valuations were rarely above 7x EBITDA, so valuations today remain strong by any rational comparative measure.

It should also be noted that in most comparable multi-site healthcare segments – dental, physical therapy, outpatient surgery – the purchase price multiples are 30-50% lower than what we see with veterinary hospitals.

With the federal government’s rapidly changing tariff policy and the shrinking of the federal workforce, the economy is challenging. The veterinary industry faces its own headwinds, particularly with continued invoice declines.

It is unclear how much longer the high valuations we see today will remain in place.

Additionally, transactions are becoming increasingly complex. Buyers are inserting more aggressive terms to protect their interests. When you sell your practice, it’s likely the biggest financial transaction of your life and having capable representation on your side can help ensure a successful outcome!

As always, time will tell. But we reiterate our advice: IF you are planning to sell in the next two years, start now to mitigate the industry downside risk.

Thank you for reading!

3 of 100

Confidential, No-Cost Valuations

Available for veterinary practices generating over $1.2M in annual revenue.

Unbiased, Data-Driven Estimates

Powered by our proprietary valuation database and extensive industry benchmarks.

Actionable Insights to Improve Profitability

Every valuation includes expert recommendations based on a detailed financial review.