Over the past ten years alone, the number of veterinary practice consolidators has exploded. In the early 2010s, there were approximately 10 corporate groups buying practices. Fast forward to today, and there are more than 35 groups and counting. What gives? Why is this industry so exciting to investors? Let’s take a look at the attributes that make the veterinary space so attractive, including its resilient qualities that were validated by the recent COVID-19 pandemic.

Adoption Trends and Industry Growth

To start, human-animal bonds and the importance of pets in family structures only grows stronger in accordance with consumer survey data. More importantly, the trends of who is adopting persist, with:

- Millennials increasingly adopting pets before they have children, and more of them adopting while still single

- Baby Boomers adopting pets as they become empty nesters

- Families continuing to adopt pets

In 2020, it seemed like everyone added pets to their families. The mainstream media popularized this idea of a massive bump in adoptions during the COVID-19 pandemic, although data from shelters seems to say otherwise. In fact, shelter data shows that 2020 and 2021 saw no material increase in adoptions because of lack of availability of pets. However, there was likely an uptick in adoptions from breeders, who were able to have more newborns over the last two years to meet the high demand.

But there’s more to the picture when looking at consumers. At Ackerman Group, we believe there’s another, arguably more important trend that has not yet been fully quantified: the socioeconomics of those adopting. This analysis is more nuanced and has not yet been verified by data, but feels intuitively reasonable to explain the rapid growth in demand for veterinary services during the pandemic. During the pandemic, service workers and lower-income families experienced significant income insecurity, making adopting a pet unaffordable and thus less feasible. On the other hand, white collar workers were working at home, and anecdotal reports showed many COVID-adoptions within this demographic who will ultimately spend more time at the veterinary hospital.

We’re also seeing more pets pay visits to the vet. Historically, 25 to 30 percent of pets did not regularly visit a veterinarian for care. Our hypothesis is that during the pandemic, higher-income families adopted, resulting in a smaller percentage of pets not receiving veterinary care. We believe that the growth in new client visits and how busy many practices are is likely due to this socio economic shift in adoptions.

Will this trend continue in 2022/2023 and beyond, with a socioeconomic shift in those who adopt pets? This is one of those unknowns that, if proven to be true, may cause industry growth to stabilize above the historical four to five percent growth level.

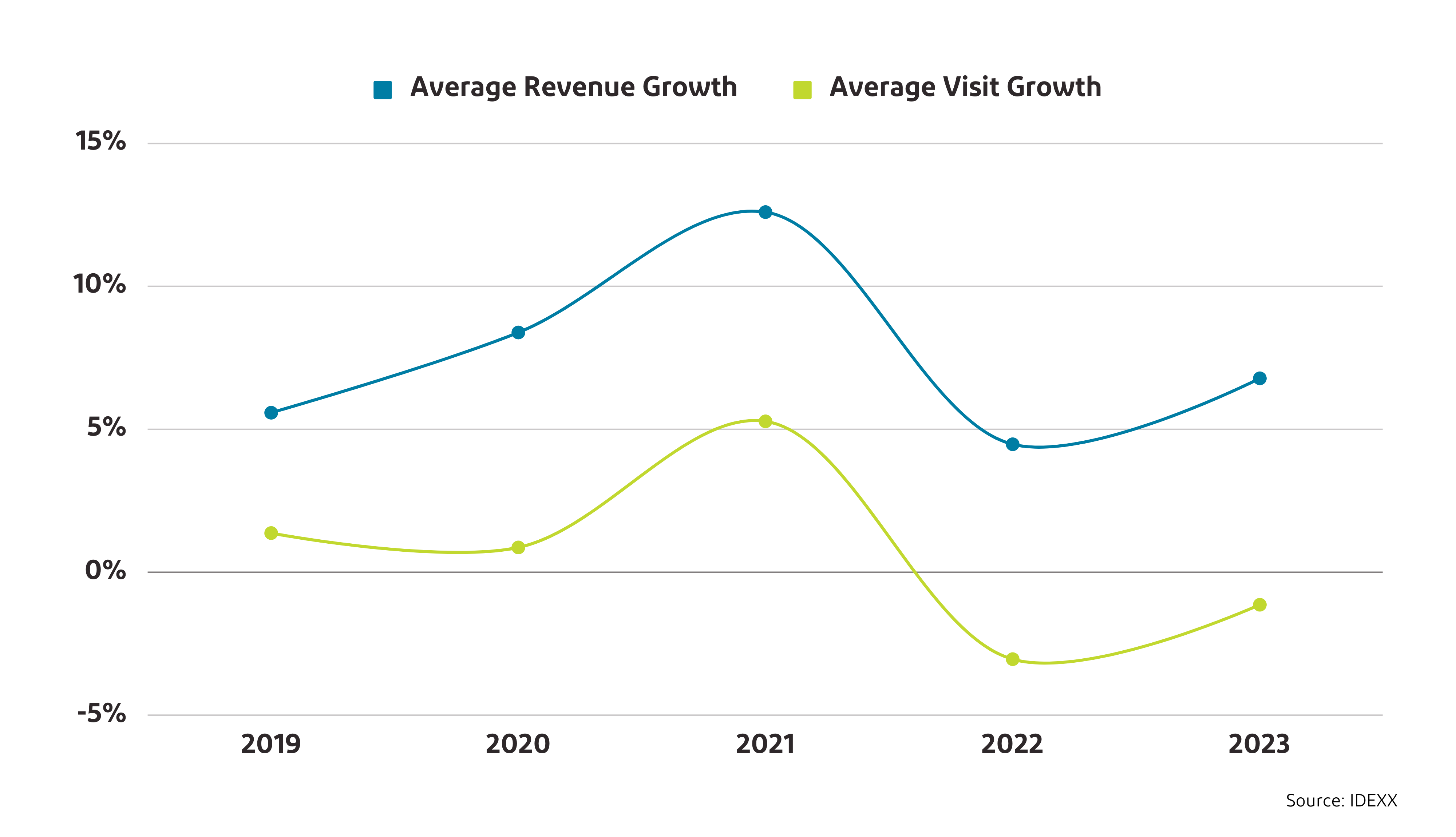

Assuming this thesis proves accurate, with a higher percentage of pets seeing veterinarians and more pet owners paying for care, it has significant upside potential for the industry. The veterinary space has historically grown at a rate of four to five percent, with a brief downturn during the 2008-2010 recession. That growth accelerated exponentially in 2020/21, with more than 11 percent growth in the industry. While 2022 remained strong it was primarily driven by pricing (visits declined 3% in 2022). In 2023 we expect visits to be flat over the course of the year and by 2024 visits and revenue growth should return to historical norms of 4-6% growth and ~1% visit growth.

Source: IDEXX

When placing the veterinary industry in an even wider context, the space is growing 2-4x faster than the national economy. During the 2010s, our nation’s GDP grew at an average of two percent every year, while the veterinary industry grew four to five percent or 2-2.5x the growth rate of the economy. This long-term growth drives investor interest, especially when factoring in pandemic performance (7-9% growth in 2020 and 11-12% in 2021 while GDP only grew 2-4%). The veterinary industry continues to outperform the economy, driving healthy “Same Store” growth and therefore providing a strong ROI to investors. The strong growth clearly abated in 2022 and in early 2023 with visits declining but revenues growth still strong due to hospitals increasing pricing to offset labor cost and drug/supply increases driven by the labor shortage and inflation.

Pandemic Performance: Comparative

There’s no doubt that pandemic performance of the veterinary industry was tremendous, as pets further solidified their importance in the lives of pet owners and their families. How does it compare to the other healthcare services where investors also heavily invest?

Over many decades of performance, veterinary and human healthcare services sectors are widely viewed as recession-resistant businesses that perform well through good and bad times. In 2020 and 2021, we saw for ourselves that the veterinary industry is also pandemic-resistant: veterinary hospitals were always open and never forced to close. Human healthcare services businesses, on the other hand, all shut down intermittently, even experiencing a few months where they posted zero revenue. From March to May of 2020, human healthcare services (from dental, to physical therapy, to dermatologists and optometrists) had to shut down in some capacity, taking massive hits to their bottom line. The return to normal happened over many months, not quickly. This chain of events opened the eyes of many investors to the vulnerabilities of the human healthcare space. It further solidified the veterinary industry as an important place where investors could gain consistent and reliable returns.

Pricing Power

With a veterinarian shortage, strong demand for veterinary services, and rising wages with the spike in inflation, veterinary hospitals were able to raise prices without impacting demand materially. Pre-pandemic, veterinary industry growth was aided by regular price increases, and there was commentary that service costs were pricing some pet owners out of the market.

But the pandemic and staff shortages have led all veterinary hospitals, particularly specialty hospitals, to push prices even more. The impact on demand seems minimal so far. Think about it: When a practice has a two or three week wait for an appointment, raising prices by five percent or more is a reasonable strategy when struggling to hire staff to meet the demand.

Again, the comparison of the veterinary industry to human healthcare is instructive in context. Raising prices at dental practices, physical therapy centers, and medical practices are much more complex with payor contracts and government reimbursement rates in the mix. This makes the veterinary industry significantly more flexible on pricing on a comparative basis and more interesting to investors!

In Summary

While those in the industry continue to experience the high demand for veterinary services from pet owners, the pandemic has solidified the space as a ‘must-have’ sector to generate strong returns irrespective of the economy. In 2021, prices for consolidators rose even further from the highs of 2018 and 2019, while individual practice valuations reached never-before-seen heights. These valuations have softened some since mid-2022 but in 2023, the valuation remain above pre-pandemic levels.

At Ackerman Group, we’re excited to see what the future holds for this formidable space and look forward to helping practice owners make the most of it.