Arriving at Your Veterinary Practice Valuation: A Comprehensive Guide

Why are Veterinary Practice Valuations Important?

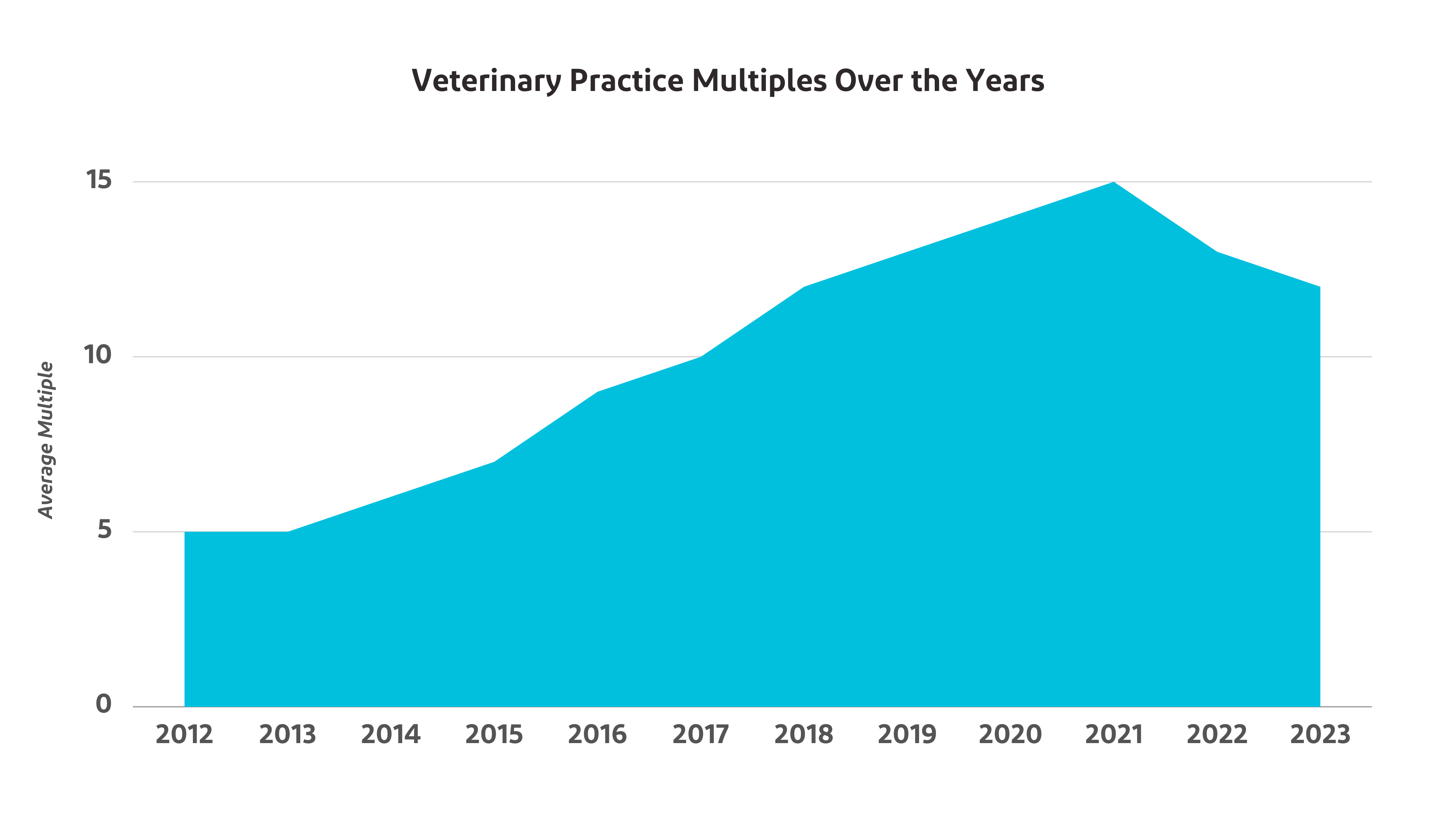

Needless to say, veterinary practices are attractive and an in-demand investment opportunity. If you’re a practice owner, you can make a pretty penny by selling your clinic, but only if your hospital meets the criteria buyers are looking for. Valuations for practices have more than doubled from 2015/16 to 2023 with corporate buyers paying 8-13x profit or EBITDA today compared to 5-6x in 2016. This means a hospital with $500,000 in profit likely sold for $2.5-3.0 million in 2016 and would sell today for about $6.0 million. In this guide, our team lifts the veil on veterinary practice valuations: why they matter, what they entail, how to determine your clinic’s worth, and more.

Why Accuracy Matters

Business appraisals vary significantly by sector – there is no “one-size-fits-all” approach, which is why choosing the right person to conduct your clinic’s valuation is crucial. The veterinary industry is a niche, standalone space that requires a unique industry knowledge to provide an appropriate valuation. Like our team at Ackerman Group, veterinary practice brokers who specialize in the veterinary industry can help create the most value for you as you go through a practice sale process. Our team knows how the private equity backed corporate buyers of veterinary practices value these businesses, whereas a general business broker or attorney may not have the same insight.

The bottom line: you don’t want any surprises when it comes time to sell. Partnering with an expert who has deep veterinary expertise will give you the most accurate estimate of value for your veterinary clinic.

Veterinary Valuations are More Complicated Than You Think

Every veterinary practice is different, and every practice has numerous data points and features that factor into its ultimate value. Take into account the ever-changing buyer’s market, and that’s why we don’t recommend using any readymade formulas or cookie-cutter “calculators” to appraise your veterinary practice.

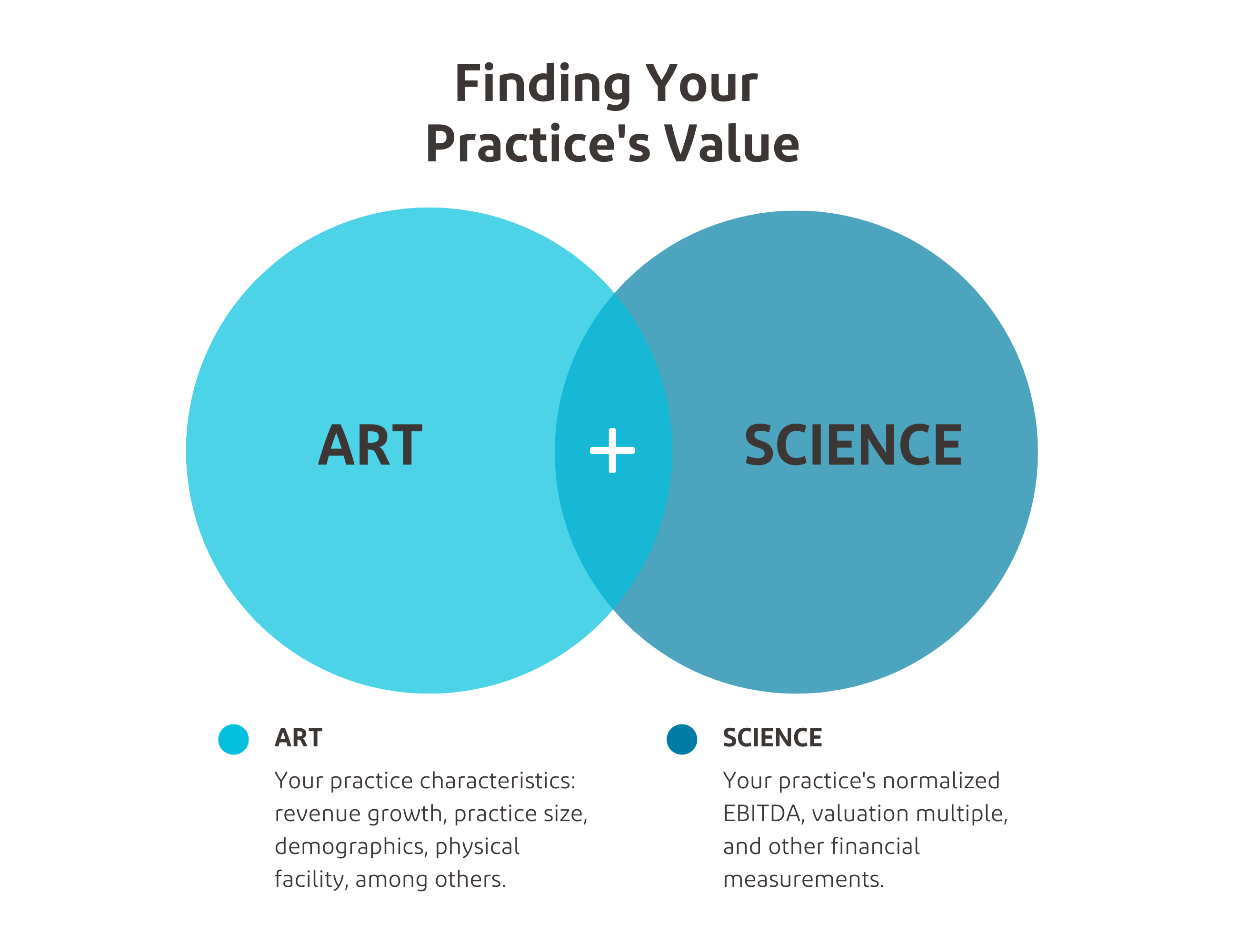

Our Co-CEO, Rich Lester, often says there’s an “art and science” to veterinary practice valuations. This is because your practice’s value is found through a combination of certain attributes (art) and hard numbers (science). Aside from your practice’s profitability, things like practice characteristics, macroeconomic factors, and buyer investment cycles all weigh into the ultimate purchase price multiple applied to your veterinary clinic.

When Should I Get a Veterinary Practice Valuation?

Before we dive into how veterinary practice valuations work, let’s discuss when you should start the initial evaluation process. Timing is just as important to your practice sale as the sale itself.

Here’s when you should begin the valuation process:

If you’re 3-5 years from selling. Getting a practice valuation does not mean you need to sell your veterinary practice immediately after. In fact, our team suggests you evaluate your clinic as early as a few years before you plan to sell. We recommend doing this for your benefit: by assessing your practice early, we can identify any areas that are negatively impacting your business’s valuation and provide guidance on how to improve those areas. With this information, you can drive improvements over time and create more value when you are ready to sell. We will also provide guidance on how to achieve those improvements.

If your practice transfers ownership. Aside from a corporate sale, if you allow any Associate DVMs or partners to buy into the practice, you’ll want to have a veterinary practice valuation for that moment in time.

If your partner leaves, retires, or passes. Should anything happen to your co-owner, you’ll want to ensure the insurance you receive is reflective of your practice’s worth (and ultimately, each owner’s stake) during that period.

If you’re applying for a business or personal loan. Knowing your practice’s value is especially important in potentially offering up if you’re qualifying for a loan.

What Determines My Veterinary Practice’s Sale Value?

If you’re conducting research, you’ve probably come across several approaches (earnings method, asset method, market method, income-based methods, etc.) to find the value of your veterinary clinic.

Our team specializes in veterinary practice sales to the corporate market only, and, we primarily use income-based methods to conduct valuations because these are the methods the corporate buyers / investors utilize. Regardless, we generally advise sellers to avoid the nitty-gritty details of these methods and, instead, focus on the following formula:

Normalized EBITDA x Purchase Price Multiple =

Your Practice’s Value

What is EBITDA?

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. Its measurement represents the cash derived from the day-to-day running of the veterinary practice. It gives investors a sense of how financially successful and operationally efficient the business is currently. Many practice owners tend to underestimate their actual EBITDA because there accountants are focused on reducing profits so you pay less taxes. When you are looking to sell, you want to show the maximum profits – which is not generally how small business owners show their financials.

We can think of normalized EBITDA as your practice’s realistic profitability if a corporate group owned it. If a corporate group owned your practice, what changes would they make to your business? What expenses would “go away”? Normalized EBITDA can be found through a series of “add-backs”, or expenses eliminated, that would no longer apply to the practice’s bottom line if it were under corporate ownership. Practice brokers who are experienced in the veterinary industry, specifically in selling to corporate groups, will know which line items to categorize as add-backs.

You can see how a measurement of normalized EBITDA frames value through the lens of an investor. However, it’s only one part of the formula for your veterinary practice appraisal. In the next section, we’ll cover the practice characteristics, economic forces, and other factors that determine your purchase price multiple.

How Is My Multiple Determined?

During a valuation, veterinary practice appraisers or brokers will assess your clinic’s level of risk associated with a potential investment. From a buyer’s point of view, their questions may be along the lines of:

- Will this risk affect the earnings I expect to make from this investment?

- How greatly will this risk impact the practice’s profitability?

- What factors do I consider “high-risk” and where does this practice land on those factors?

Different buyers place different weights on the variety of risk factors and criteria that are typically evaluated based on each buyer’s priorities and experiences. Different buyers will use different EBITDA multiples in assessing a practice – which is why having a robust sales process is important to achieving the best price and best terms.

The multiple is essentially multiplied by the normalized EBITDA to determine the valuation a buyer is willing to pay for your veterinary practice with the expectation that they’ll make money back and then some. For example, if a veterinary practice has a multiple of 10x, the clinic is valued at 10 times the normalized annual EBITDA.

Other factors (which we’ll discuss in the next section) also affect the multiple applied to your veterinary practice. As it relates to risk factors specific to your clinic, we’ve put together a quick guide to the left so you can gauge where you fall on the scale.

In 2023, the range of multiples that are being paid for veterinary practices is between 8-13x. The practices receiving 12-13x have most of the characteristics shown on the right side of the chart while those selling for 8-9x EBITDA have most of the characteristics shown on the left side of the chart.

What Other Factors Impact My Multiple?

Practice characteristics are the potential risks that affect your multiple on a micro level, but multiples across the veterinary market are also affected by “macro” conditions. The economy, interest rates, financing availability, risk tolerance, and more all factor into your veterinary practice’s multiple.

In 2021, practices sold for 12-18x EBITDA due to macro-economic conditions that included really low interest rates and really rapid growth in revenues at veterinary hospitals due to COVID. In 2023, the range has adjusted to 8-13x EBITDA as interest rates have risen materially and revenue growth in the industry has slowed. The risk characteristics outlined in the prior section still determine where in the range of multiples an individual practice will sell but the range has shifted due to these macro factors.

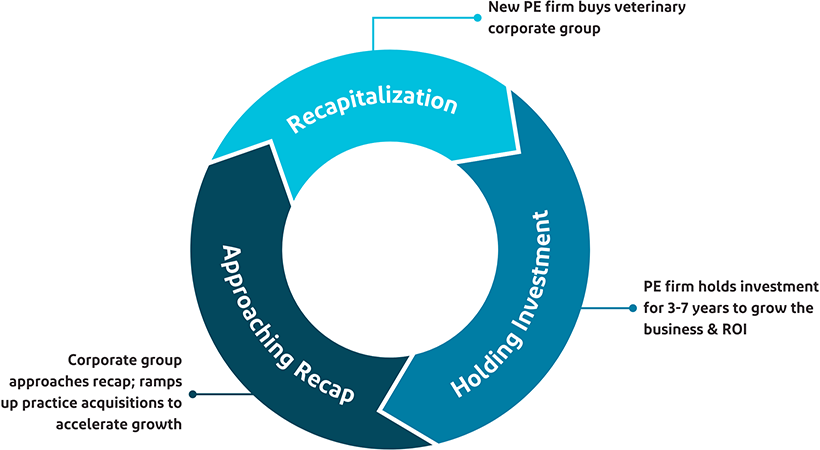

Buyer investment cycles also come into play. Buyers (corporate groups) tend to step up their acquisitions as they approach recapitalization in an effort to accelerate their growth and thus attract more PE firms. Generally, corporate groups are much more open to buying veterinary practices at this stage than at any other period in their investment cycle.

Click to enlarge.

Click to enlarge.

How Does Ackerman Group Value Veterinary Practices?

Many factors, both in and out of your control, go into valuing veterinary clinics. Our team works with practice owners to first understand their business’s true profitability through a comparison of prior sales as well as EBITDA normalization. With that process, we also bring:

Knowledge of and access to real-time market changes

How your practice places in the overall market

Experience in accurately evaluating practice characteristics

How your practice’s features contribute to your multiple

A deep understanding of corporate groups and their buying strategies

How buyers will view your practice from an investment and timing standpoint

A focus on both short-term and long-term value

How certain deal structures yield value for you now vs. in the long run

Curious about how much your practice is worth? We offer no-cost, no-obligation veterinary practice valuations for hospitals that generate annual revenues greater than $1.2 million.