Veterinary

Practice Sales

Q1 Market Update

APRIL 2025

Backed by extensive research and data

exclusively from Ackerman Group

Backed by extensive research and data exclusively from Ackerman Group

To our Readers

Rich Lester

(207) 450-8800

rlester@ackerman-group.com

Gary Ackerman

(804) 334-7387

Ackerman Group is proud to bring you this latest edition of our quarterly research report. Backed by our extensive practice sales dataset and our team’s decades of experience advising on transactions, this report is intended to provide the veterinary practice owners, as well as the broader profession, with insights and analyses found nowhere else in the industry.

While not a detailed guide to selling your hospital, this report highlights real-time trends we are observing in the market to help position you and our clients for the best outcomes possible during a sale process.

Should you find yourself thinking about selling your practice, and wish to take advantage of our unmatched market experience and extensive data set, Ackerman Group is ready to assist you from beginning to end. Hundreds of veterinarians have entrusted us with advising them on the sales of their practices and during the increasingly important time post-sale when incremental value is frequently earned in transactions today. Our goal is to align with your personal, professional, and financial goals.

We wish you and your practice continued SUCCESS.

Don’t hesitate to reach out with your questions!

Rich Lester

Chief Executive Officer,

Ackerman Group

Gary Ackerman

Founder, and CEO Emeritus,

Ackerman Group

Rich Lester

Chief Executive Officer,

Ackerman Group

Gary Ackerman

Founder, and CEO Emeritus,

Ackerman Group

Executive Summary

Both the economy and the veterinary industry are experiencing turbulent times, but practice valuations seem to ignore the uncertainty. Valuations remain robust despite the headwinds.

The Highlights:

- Purchase price multiples remained stable for GP Practices for deals closed in Q1 2025, with larger practices still in the 12-15x EBITDA

- Despite high interest rates, we have seen up-front cash on Ackerman Group transactions stabilize at 71% of total consideration in Q1 2025.

- A handful of large acquirors with aggressive growth goals are active nationally as well as a number of small / mid-sized buyers remaining active in their selected geographies.

- The Federal Reserve is holding interest rates flat given all the economic uncertainty.

- The major industry headwind remains veterinary invoice growth which has been negative for 3 straight years – 2022, 2023 and 2024, with invoices down over 2% each year. Q1 2025 seems to be continuing this downward trend.

Riders on the storm

Into this house, we’re born

Into this world, we’re thrown

Like a dog without a bone

The Doors, 1971

We will start our first quarter review with a look at the uncertainty in the U.S economy. We will then look at the veterinary industry trends and the continued robust market for sellers of veterinary practice.

Ackerman Group at a Glance

The Veterinary Professionals Leading Broker

$1.8 BN+

In combined value of veterinary practices brokered by our team since 2020.

240+

Veterinarians we have assisted on the sale of their veterinary practice.

70+

Years of collective experience of our Senior Partners in the veterinary industry.

The Current State of the U.S. Economy

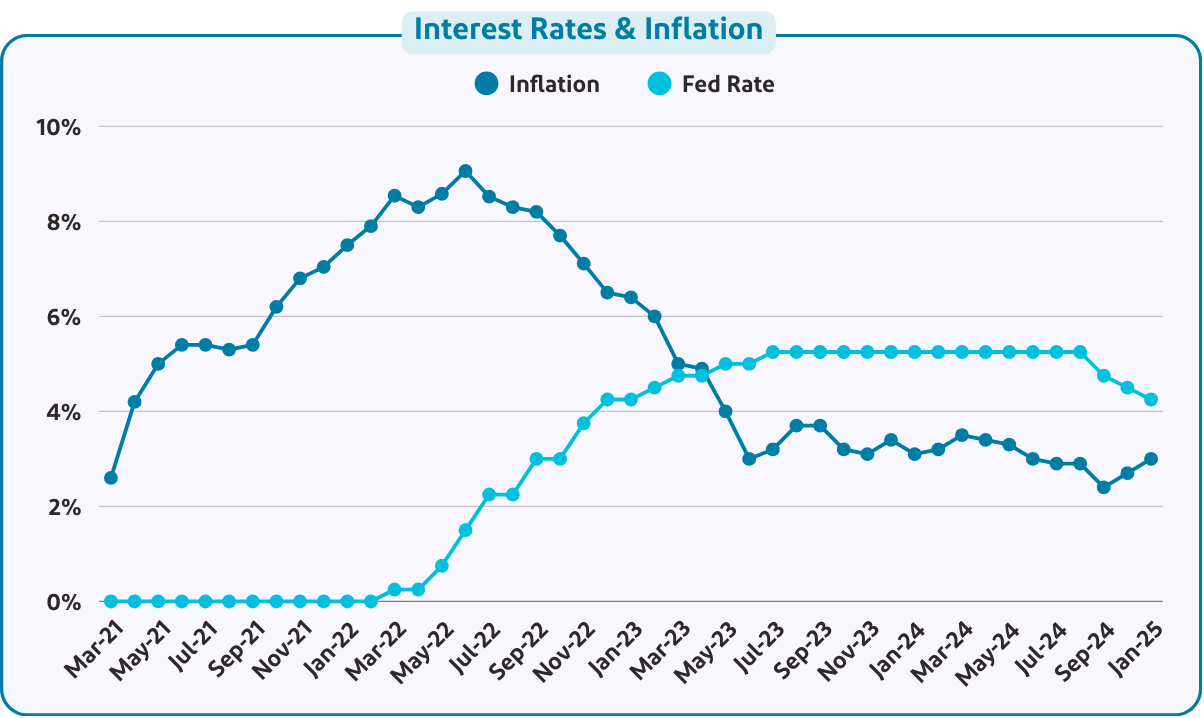

Inflation has been hovering around the 3% mark with interest rates having stabilized at 4.25% since December.

The chart below shows that monetary policy worked to ease inflation post-COVID, with further interest rate cuts not likely coming anytime soon given the uncertainty of the President’s tariffs and massive layoffs in government sector jobs.

The Current State of the U.S. Economy, cont.

Elon Musk and DOGE have been empowered to dramatically shrink the government bureaucracy, which at least temporarily is increasing unemployment. The tangential pro-growth impact of the government job cuts is to effectively de-regulate the economy because there are not enough government officials to enforce rules. The results of these efforts might be a recession, but it is also likely a permanent reshaping of the federal government.

As economic forecasters observe President Trump retaliating against law firms that pursued criminal charges against him under the Biden administration, this is likely to discourage negative public statements about the economy more than in typical circumstances. However, it is important to note that:

1. Consumer confidence is at a 12-year low:

Consumer Confidence, Conference Board

https://www.conference-board.org/topics/consumer-confidence

2. The Secretary of the Treasury cannot guarantee that we won’t go into a recession:

Scott Bessent: ‘I can’t guarantee’ America will avoid a recession”, CNN

https://www.cnn.com/2025/03/18/economy/bessent-recession-comments/index.html

Yes, and how many times can a man turn his head

And pretend that he just doesn’t see?

The answer, my friend, is blowin’ in the wind

Bob Dylan, 1986

In his first term, President Trump was intensely focused on stock market performance as a measure of his success. This time around, however, he appears more committed to executing his ‘drain the swamp’ agenda—targeting Washington’s bureaucracy—than prioritizing economic growth.

Bottom line, with the uncertainty for manufacturers and importers regarding tariffs and major job dislocation caused by DOGE, the economy is in a tenuous situation with growth likely slowing – and the odds of a recession rising.

Negative Veterinary Industry Growth

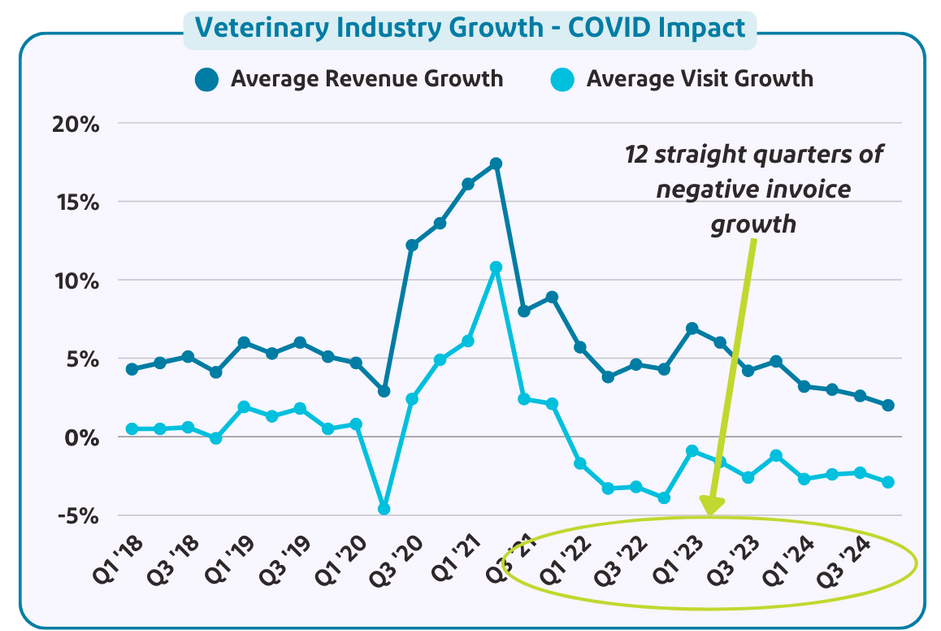

The industry is fighting strong headwinds. The chart below, based on IDEXX data, shows despite continued revenue growth of 3-6% per years, the veterinary industry is in its 13th consecutive quarter of negative invoice growth of at least negative 2% per quarter.

This means most all the revenue growth in those periods is due to price increases. This is an unprecedented negative trend for veterinary practices.

Against the wind

A little something against the wind,

I found myself seeking shelter against the wind

Bob Seger, 1980

What is causing the decline?

- Practices raised prices aggressively in 2020/2021 when demand was insatiable. These price increases have likely impacted clients’ willingness to visit.

- Covid pets are now older and these pets are visiting clinics less frequently as adults than they did as puppies and kittens.

- The economic uncertainty is making consumers more cautious.

Is the invoice decline a cyclical downturn that will revert back to the predictable ~1% invoice growth of the 2010s?

Remember, it was the stable predictable growth we saw in the 2010s that brought the piles of investment capital into the industry and drove purchase prices for practices from 4-6x EBITDA pre-2016 to today’s 8-15x EBITDA. Invoice growth trends in 2025 and 2026 will determine valuation trends for years to come.

Our view is that a return to invoice growth is unlikely in 2025 because consumer confidence is Iow and recession fears are rising. This is not a good trend for the veterinary industry.

Our Takeaway:

Our concern is that IF invoice growth is negative for a 4th year in a row, investors will start to view the change as a fundamental industry issue (not a cyclical correction) that is not likely to return to the stable 1% invoice growth of the 2010s

If growth stays negative in 2025 we think investor sentiment starts to change regarding the industry, potentially leading to valuation declines.

IF invoices flatten or grow slightly in the later part of 2025, then we think valuations will remain strong.

Despite Headwinds,

Industry Valuations are Strong

Practice valuations remained strong and steady in Q1 2025 after increasing in 2024, while industry growth and the economy continue to falter.

Sellers today, are getting what they need!

You can’t always get what you want

But if you try sometimes, well, you might find

You get what you need

Rolling Stones, 1969

Not a Bubble, But Are Valuations Peaking?

The economic rationale for such high valuations is weak. With industry invoice growth in decline and interest rates still elevated, it is difficult to make a strong case for valuations rising in 2024—or for them to sustain their current levels for much longer.

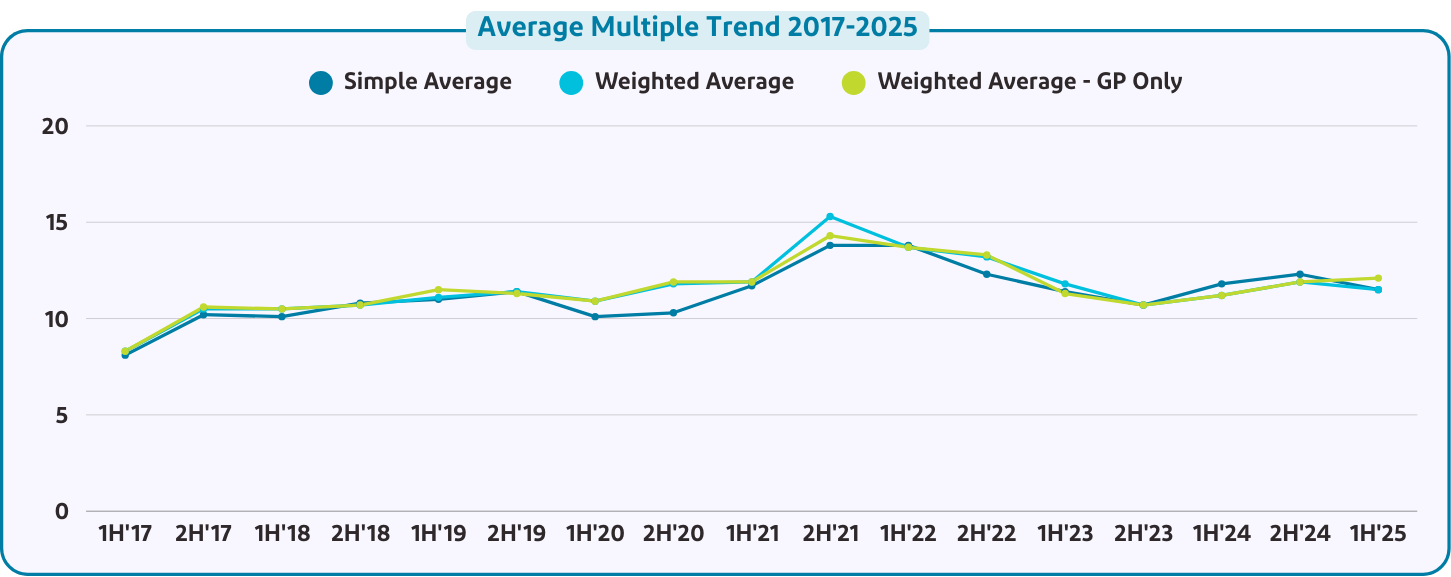

The chart below shows the positive valuation trend that started to inch up in the 1H24, accelerated into 2H24, and stabilized in Q1 2025. Average multiples of Ackerman Group deals at close to 12x.

Important Trends from this Data:

- The decline in the simple average (blue line) indicates that Ackerman closed a higher number of smaller deals in Q1 2025, lowering the overall average.

- Weighted Average General Practice (green line) deals continued to rise to over 12x.

Not a Bubble, But Are Valuations Peaking? (cont.)

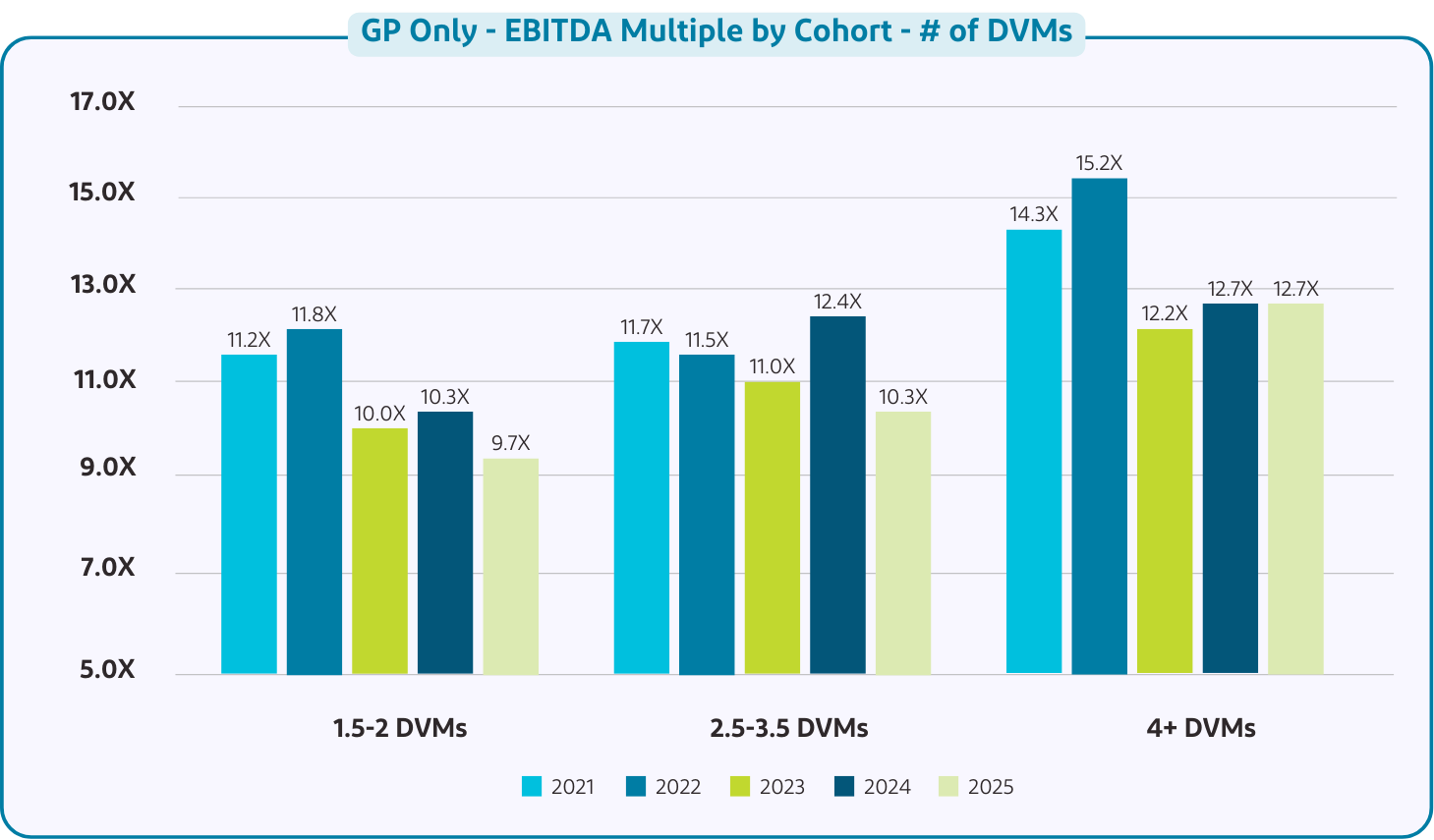

This re-enforces the notion that the higher EBITDA practices are driving the overall increase in multiples. It is clear that buyer demand remains high and the number of quality sellers – defined as hospitals with 4+ DVMs and at least $750,000 of EBITDA – is low, creating a supply/demand imbalance that has been driving pricing up.

The chart above displays EBITDA multiples by the number of DVMs per year.

While multiples have declined from their peaks in 2021–2022, the upper range in 2025 has remained stable.

The Dormant Recap Market Showed Signs of Life in Late 2024

![]() The large veterinary consolidator recapitalization market (finding a new investor to buy-out existing investors) has been dormant since mid-2022 when Vetcor and Peoples Pets & Vets merged. After 2.5 years, the merger of Southern Veterinary Partners (SVP) and Mission Veterinary Partners (MVP) closed in December 2024. With a capital infusion from Silver Lake Partners, the merger created a 700+ hospital group and provided some liquidity for doctors owning TopCo equity in both SVP and MVP.

The large veterinary consolidator recapitalization market (finding a new investor to buy-out existing investors) has been dormant since mid-2022 when Vetcor and Peoples Pets & Vets merged. After 2.5 years, the merger of Southern Veterinary Partners (SVP) and Mission Veterinary Partners (MVP) closed in December 2024. With a capital infusion from Silver Lake Partners, the merger created a 700+ hospital group and provided some liquidity for doctors owning TopCo equity in both SVP and MVP.

![]() The SVP/MVP deal closed at a good valuation – 17-18x EBITDA. There are number of other mid-sized and large consolidator groups that are looking to recapitalize. We know the recapitalization market is differentiating based on performance, in particular invoice growth. SVP/MVP has generated above market invoice growth the last few years leading to a good valuation by today’s standards (but below the frothy levels of 2021 / early 2022).

The SVP/MVP deal closed at a good valuation – 17-18x EBITDA. There are number of other mid-sized and large consolidator groups that are looking to recapitalize. We know the recapitalization market is differentiating based on performance, in particular invoice growth. SVP/MVP has generated above market invoice growth the last few years leading to a good valuation by today’s standards (but below the frothy levels of 2021 / early 2022).

![]() Consolidators that have struggled with invoice growth are likely to see lower valuations, which may delay their recaps. Business fundamentals do matter in the current market and the strong performers will be rewarded.

Consolidators that have struggled with invoice growth are likely to see lower valuations, which may delay their recaps. Business fundamentals do matter in the current market and the strong performers will be rewarded.

For the individual practice owner, it is important to understand that as larger corporate groups look to recapitalize, they will want to accelerate their growth by acquiring more hospitals. The rising multiples, are being primarily driven by the increased demand from buyers and not industry fundamentals (which are weak).

![]() If the recapitalization market offers lower multiples for consolidators whose performance is not as strong as SVP/MVP, that may lead those buyers to start putting valuation pressure on the individual practice market. If the valuations of the consolidators softens, the individual practice sale market will inevitably follow. This is our concern and why we think selling now is a good idea for those thinking of selling in the next two years!

If the recapitalization market offers lower multiples for consolidators whose performance is not as strong as SVP/MVP, that may lead those buyers to start putting valuation pressure on the individual practice market. If the valuations of the consolidators softens, the individual practice sale market will inevitably follow. This is our concern and why we think selling now is a good idea for those thinking of selling in the next two years!

Transaction Terms and Trends Remain Strong

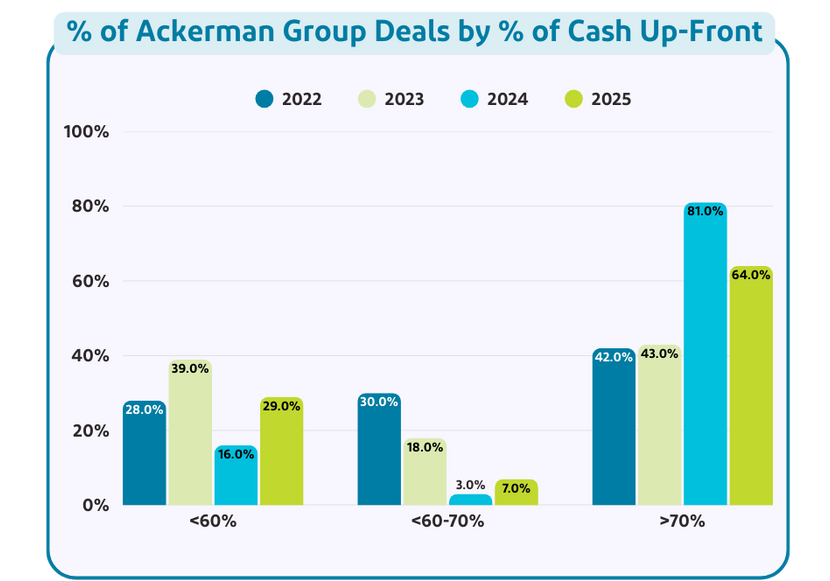

The most important deal trend that we track is the percentage of cash at closing, which has slipped some from the lofty 2024 levels where 81% of the deals had at least 70% cash up-front.

In 1Q 2025, only 64% of deals had 70% or more cash at close—a slight decline from prior periods. Still, the average cash at close remained relatively strong at 71%, suggesting that while fewer deals are meeting the higher-cash benchmark, those that do may be offering even more cash upfront. This is a trend we watch closely, especially for those seeking to diversify their assets as they approach retirement.

Note, the data is different from what we have previously published because a number of deals have exactly 70% cash at close and we adjusted the last grouping to 70% or more (from over 70%).

Real Owners. Real Opinions.

![]()

“I knew the farm side of the business was worth something, so instead of quitting, I wanted to try to sell. I went to Western [Veterinary Conference] not even knowing the difference between a broker and a corporate buyer. Rich was the only person who accepted my questions and talked to me,” said Dr. Ketner, “And he actually followed up with me after. First impressions, to me, mean a lot, and that was a major reason why I decided to work with Ackerman Group.”

![]()

“I’ve been in the banking world for almost 30 years, so I was familiar with the processes [of selling] and was fearful of what I was getting myself into. Ackerman Group made it more seamless than I anticipated.”

Summary

As an industry, we want to hold on to these valuations as long as possible and some believe it will continue indefinitely. We tend to recommend being practical and taking action when conditions are favorable – which is right now!

Don’t forget: Before 2017, a price for a veterinary practice above 7x EBITDA was unusual, so valuations today are strong on any rational comparative measure.

It should also be noted that in most comparable multi-site healthcare segments – dental, physical therapy, outpatient surgery — the purchase price multiples are 30-50% lower than what we see with Veterinary Hospitals.

The combination of the federal governments rapidly changing policies around tariffs and the shrinking of the federal workforce is impacting the economy. The veterinary industry also has its own headwinds with invoice declines – it is unclear how much longer the high valuations we see today will remain in place.

As always, time will tell but we reiterate our advise of – IF you are planning to sell in the next two years, start now to mitigate the industry downside risk.

Thank you for reading!

Questions? Reach out to our team of advisors:

3 of 100

Did you know?

Ackerman Group offers confidential, no-cost, no-obligation

valuation analyses for practices with annual revenues over $1.2MM.

Each analysis leverages our proprietary database of hospital valuations and our team’s vast knowledge of key practice performance metrics to provide owners with an unbiased valuation estimate and expert recommendations for profitability improvement opportunities uncovered through our research of your financials.