Veterinary

Practice Sales

Q3 Market Update

OCTOBER 2025

Backed by extensive research and data

exclusively from Ackerman Group

To our Readers

Rich Lester

(207) 450-8800

rlester@ackerman-group.com

Gary Ackerman

(804) 334-7387

Ackerman Group is proud to bring you this latest edition of our quarterly research report. Backed by our extensive practice sales dataset and our team’s decades of experience advising on transactions, this report is intended to provide veterinary practice owners, as well as the broader profession, with insights and analyses found nowhere else in the industry.

While not a detailed guide to selling your hospital, this report highlights real-time trends we are observing in the market to help position you and our clients for the best outcomes possible during a sale process.

Should you find yourself thinking about selling your practice and wish to take advantage of our unmatched market experience and extensive dataset, Ackerman Group is ready to assist you from beginning to end. Hundreds of veterinarians have entrusted us with advising them on the sales of their practices, and during the increasingly important time post-sale, when incremental value is frequently earned in transactions today. Our goal is to align with your personal, professional, and financial goals.

We wish you and your practice continued success. Don’t hesitate to reach out with your questions!

Rich Lester

Chief Executive Officer,

Ackerman Group

Gary Ackerman

Founder, and CEO Emeritus,

Ackerman Group

Executive Summary

- Delayed Closings: We have seen a number of deals restructured as Seller revenue and invoice growth declined during the 6-8 month transaction process.

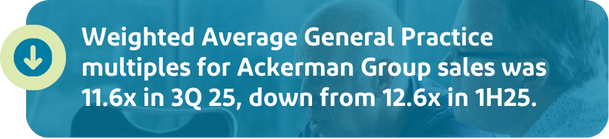

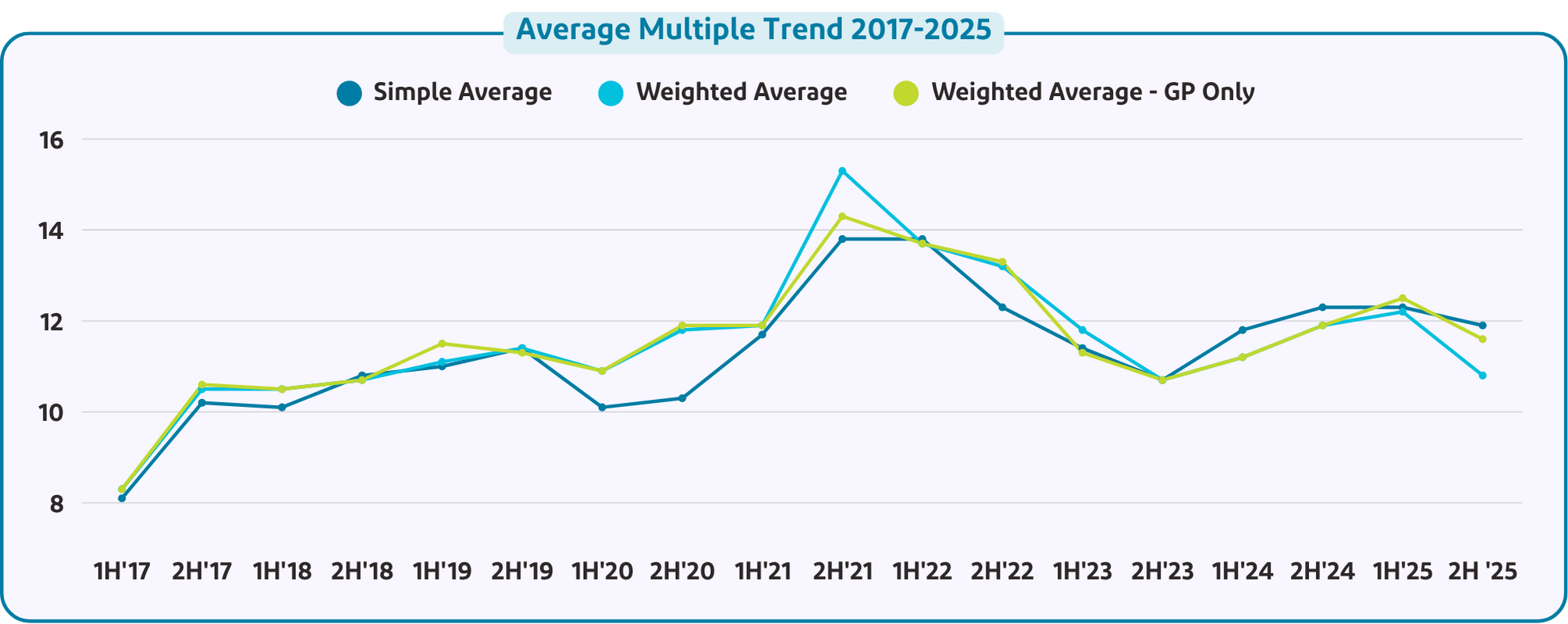

- Purchase Price Multiples moderated in Q3 2025. Q4 will be materially more active than Q3 and we expect multiples for 2H25 to be down slightly from 1H25 but higher than the Q3 data.

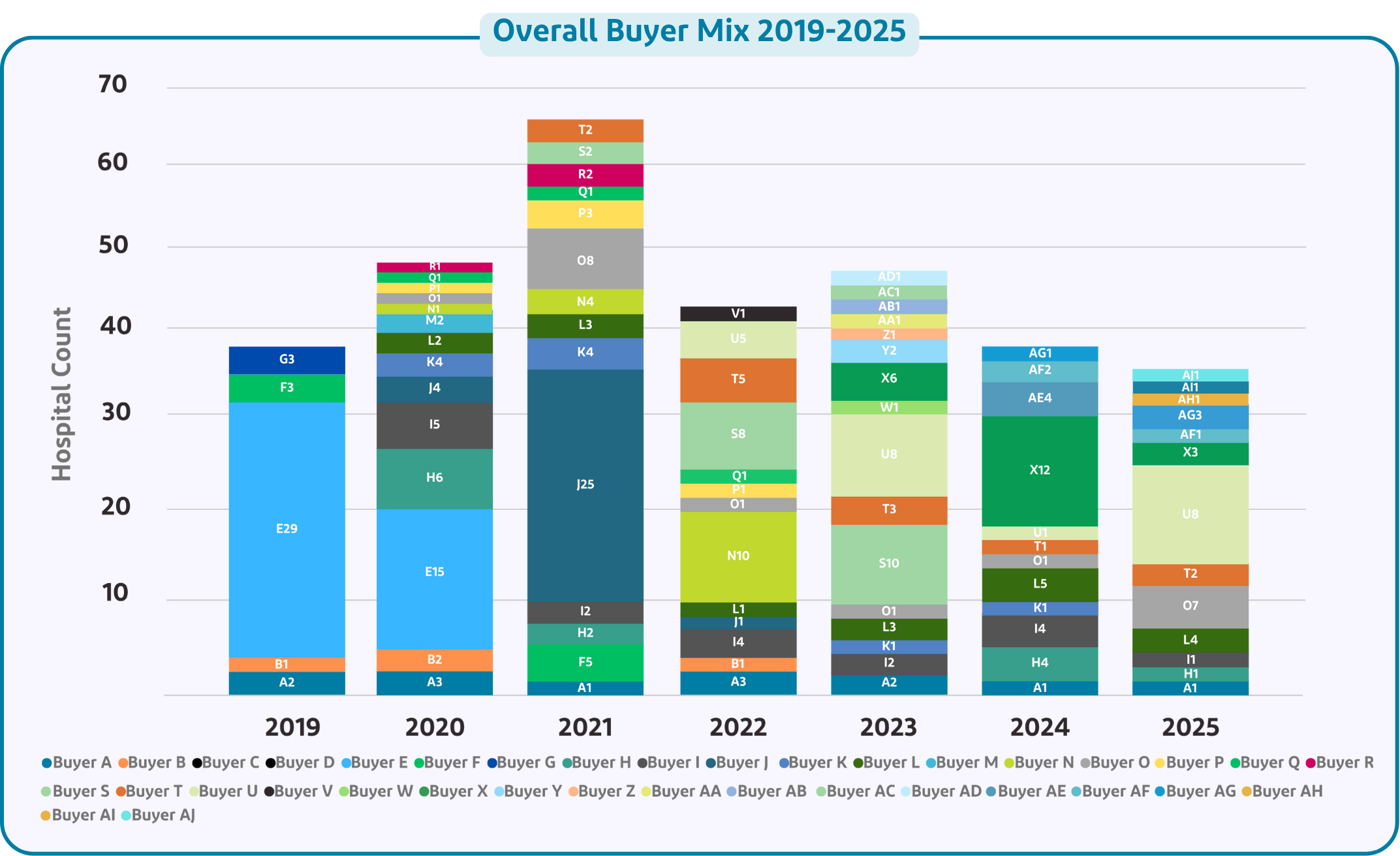

- Many Active Buyers continue to drive the market as Ackerman Group has sold 34 hospitals in the United States to 14 different buyers in the first 9 months of 2025.

- Invoice Growth remains the major industry headwind. Invoice counts have declined for 3 straight years – 2022, 2023 and 2024, with invoices down over 2% each year. The first half of 2025 saw invoice declines of over 3% and Q3 2025 is expected to be similar.

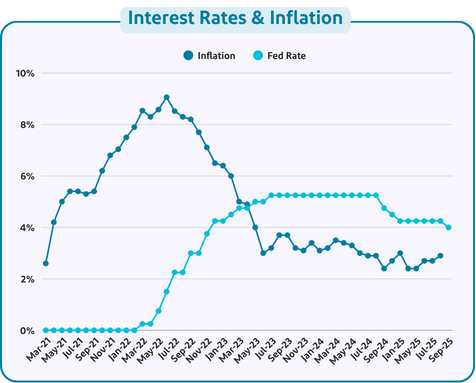

- Interest rates were finally lowered by the Federal Reserve in September with more rate cuts expected this year. Rate cuts should help the economy and potentially start to reopen the dormant recapitalization market for veterinary consolidators.

The U.S. and world economy remain uncertain with tariffs, labor market issues and wars in the Middle East and Ukraine, but businesses and the stock market appear to be adapting to this ‘new normal’.

Ackerman Group at a Glance

The Veterinary Professionals Leading Broker

$2.1 B+

In combined value of veterinary practices brokered by our team since 2020.

265+

Veterinarians we have assisted with the sale of their veterinary practices.

75+

Years of collective experience among our Senior Partners in the veterinary industry.

The Current State of the U.S. Economy

Economists spent months warning that President Trump’s tariffs would drive up inflation—but the expected rise didn’t come right away. This summer, those predictions materialized: inflation rose from 2.4% in May to 2.9% in August, nearly returning to the 3.0% level seen when he took office in January.

However, despite these inflation levels, the Federal Reserve cut interest rates in September, in what is anticipated to be the first in a series of reductions aimed at boosting economic growth. The Fed’s challenge, at present, is balancing the need to boost the economy and job growth through lower interest rates, while not intensifying the rising prices for goods and services (i.e. inflation) brought on by Trump’s tariffs.

Negative Veterinary Industry Growth

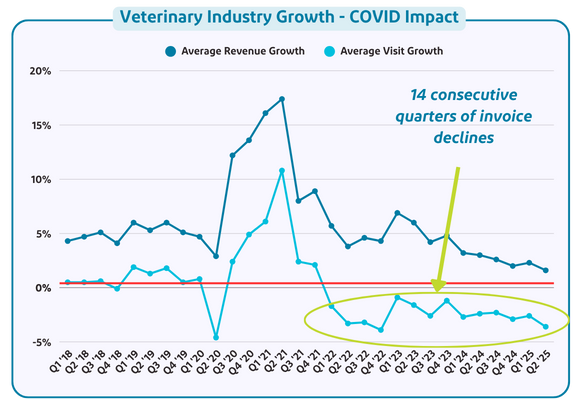

Unfortunately, the veterinary profession continues to struggle to drive positive visit growth. As evidenced in the chart below, IDEXX’s proprietary practice data set shows that revenue growth is slowing further and the industry has now experienced 14 consecutive quarters of declining invoices. Q2 2025 marked one of the worst quarters we have seen during this 3.5 year period with visits down -3.6%.

Against the economic backdrop of weakening job growth and uncertainty around overall consumer spending, we anticipate Q3 2025 to be the 15th consecutive quarter of invoice declines.

What is causing the decline?

- Practices raised prices aggressively in 2020/2021 when demand was insatiable and these price increases have likely impacted clients’ willingness to visit.

- COVID puppies and kittens have become adults, which tend to visit clinics less frequently (until they become seniors).

- Economic uncertainty is making consumers more cautious.

While we have not done the math, we have seen others report that invoice growth from 2000 to mid-2025 has essentially been 0%. Thus, the torrid growth during Covid has been fully offset by these 3.5 years of invoice declines.

What is causing the decline?

- Practices raised prices aggressively in 2020/2021 when demand was insatiable and these price increases have likely impacted clients’ willingness to visit.

- COVID puppies and kittens have become adults, which tend to visit clinics less frequently (until they become seniors).

- Economic uncertainty is making consumers more cautious.

Is the invoice decline a cyclical downturn that will revert back to the predictable ~1% invoice growth of the 2010s?

It was the stable, predictable invoice growth in the 2010s that brought the massive influx of investment capital into the industry and drove purchase prices for veterinary practices to today’s 8-15x EBITDA from pre-2017 levels of 4-6x.

Is the invoice decline a cyclical downturn that will revert back to the predictable ~1% invoice growth of the 2010s?

It was the stable, predictable invoice growth in the 2010s that brought the massive influx of investment capital into the industry and drove purchase prices for veterinary practices to today’s 8-15x EBITDA from pre-2017 levels of 4-6x.

What does this mean for practice owners?

The concern is IF invoice growth is negative for a 4th year in a row (2025), will investors start to view it as a fundamental industry issue (not a cyclical correction). We think investor sentiment could start to change, potentially leading to valuation declines.

However, the industry has remained resilient despite these headwinds, and we know investors are counting on above average invoice growth starting in 2027-28 as COVID puppies and kittens become seniors (over 7 years old), likely requiring more visits.

Are Headwinds Finally Impacting Valuation?

Practice valuations improved during a strong 1H25, but softened slightly in the 3rd Quarter. However, some dynamics lead us to question the extent of this softness:

- A small sample size: only five practice sales in the dataset

- A large, single-specialty transaction skews the weighted average measure

We expect to complete 12-18 transactions in Q4, which will provide clarity for the 2H25. Based on signed LOI terms, we do expect a softening in valuations, but not to the extent shown by the 3rd quarter info.

We remain cautious that the economic rationale for such high practice valuations is weakening in the face of economic conditions and veterinary medicine’s visit growth challenges.

3 Market Trends to Monitor

1 Weakening Hospital Performance

The most important thing for potential sellers to understand is that maintaining strong performance throughout the entire 6–8 month transaction process is critical.

- Invoice and revenue declines vs. prior year for several of the months mid-transaction

- Associate DVM departures prior to a sale being announced

We have seen a number of transactions restructured due to growth challenges with most of them having some of the original cash turning into a ‘holdback’ that is paid only if the revenues or profits return to the original expected level. These situations are not simple, but with good advice, they can be navigated.

2 Bifurcated Market

It is important to know that if your practice has continued to grow in 2025 – with revenues and invoices above 2024, then you would likely receive a premium valuation for your practice.

Sometimes, owners believe that when their business is performing well, why sell? We are in a choppy economy combined with robust demand for strong practice, making strong growing practices hard to find – and therefore receiving premium valuations. Sell from strength!

3 Market Trends to Monitor (cont.)

3 Buyer Diversity

From our perspective, a key market data point is the variety of buyers that are still active. Ackerman Group has closed deals with 14 different buyers for the 34 U.S hospitals that we sold in the 9 Months of 2025 (graph below includes 1 Canadian Hospital). The interest in veterinary hospitals is not driven by a few large buyers but rather a wide range of active buyers are driving high valuations. Smaller / mid-sized buyers are bidding aggressively for hospitals that fit their investment criteria.

The Dormant Recap Market Showed Signs of Life in Late 2024:

Will it Reinvigorate in 2026?

The large veterinary consolidator recapitalization market (finding a new investor to buy-out existing investors) had been dormant since mid-2022 when Vetcor and Peoples Pets & Vets merged. The merger of Southern Veterinary Partners (SVP) and Mission Veterinary Partners (MVP) that closed in December 2024 was the first large recapitalization in 2.5 years.

The SVP/MVP deal closed at a good valuation – 17-18x EBITDA. However, we are now over nine months since that deal closed and there have been no other successful recapitalizations. There are a number of mid-sized and large consolidators that are or will be looking for new investors. September’s interest rate cut will likely lead to more rate cuts which may reinvigorate this market.

For the individual practice owner, it is important to understand that as larger corporate groups look to recapitalize, they want to accelerate their growth by acquiring more hospitals. The strong multiples we have been seeing in the industry are being driven by the increased demand from consolidators that want to show growth before they recapitalize.

We will be carefully watching the trends in the recapitalization market because if those deals happen at lower multiples, it could lead to lower multiples for individual hospitals. If the recapitalization market validates the SVP / MVP multiple, then we would expect the individual market to continue at the current valuation levels.

“3 Legs of the Stool”

When practice owners wonder about the ‘optimal’ time for them to consider a sale, we use the analogy of a three-legged stool. When all three legs are strong, great outcomes are achievable. Think of these as the legs: 1) the individual owner, 2) the practice and 3) the market.

When thinking about the time to sell, the questions include:

- Are you, the owner, emotionally and financially ready to transition?

- Is the practice in a good spot with doctor staffing and profits to help maximize your value?

- Is the market strong or at least good in terms of valuations?

Having all three legs of the stool align is rare and if they are in place, don’t delay! Having two of the three aligning is where most practices in the market find themselves and can lead to very good outcomes.

Real Owners. Real Opinions.

![]()

“By ourselves, we had previously received an offer from NVA that seemed low to us. With the sale, JV earnings, and earnouts achieved, we ended up making 17 million more than that initial offer. I know we hear comments about the commission rate on sales, but look what we achieved with it! We can absolutely state that the commission price was money well invested.”

![]()

“I’ve been in the banking world for almost 30 years, so I was familiar with the processes [of selling] and was fearful of what I was getting myself into. Ackerman Group made it more seamless than I anticipated.”

Summary

For the profession’s benefit, we hope valuations remain healthy indefinitely!

Don’t forget: Before 2017, veterinary practice valuations were rarely above 7x EBITDA, so valuations today are strong on any rational comparative measure.

It should also be noted that in most comparable multi-site healthcare segments – dental, physical therapy, outpatient surgery, etc. – purchase price multiples are 30-50% lower than what we see with veterinary practices.

Given the economy and the downtick in valuation we have seen in 3Q25 and expect to see for 2H25, we are hopeful that the interest rate cuts will help keep pricing relatively stable.

Know that transactions are getting more and more complex as buyers try to conserve cash and manage their downside risks. Buyers are inserting more aggressive terms to protect their interests.

When you sell your practice, it is likely the biggest financial transaction of your lifetime and having capable representation on your side will help you achieve a successful outcome!

As always, time will tell but we reiterate our advice of – IF you are planning to sell in the next two years, start now to mitigate the industry downside risk.

Thank you for reading!

Questions? Reach out to our team of advisors:

3 of 100

Confidential, No-Cost Valuations

Available for veterinary practices generating over $1.2M in annual revenue.

Unbiased, Data-Driven Estimates

Powered by our proprietary valuation database and extensive industry benchmarks.

Actionable Insights to Improve Profitability

Every valuation includes expert recommendations based on a detailed financial review.