Veterinary

Practice Sales

Q4 Market Update

JANUARY 2026

Backed by extensive research and data

exclusively from Ackerman Group

Backed by extensive research and data exclusively from Ackerman Group

To our Readers

Rich Lester

(207) 450-8800

rlester@ackerman-group.com

Gary Ackerman

(804) 334-7387

Ackerman Group is proud to bring you this latest edition of our quarterly research report. Backed by our extensive practice sales dataset and our team’s decades of experience advising on transactions, this report is intended to provide veterinary practice owners, as well as the broader profession, with insights and analyses found nowhere else in the industry.

While not a detailed guide to selling your hospital, this report highlights real-time trends we are observing in the market to help position you and our clients for the best outcomes possible during a sale process.

Should you find yourself thinking about selling your practice and wish to take advantage of our unmatched market experience and extensive dataset, Ackerman Group is ready to assist you from beginning to end. Hundreds of veterinarians have entrusted us with advising them on the sales of their practices, and during the increasingly important time post-sale, when incremental value is frequently earned in transactions today. Our goal is to align with your personal, professional, and financial goals.

We wish you and your practice continued success. Don’t hesitate to reach out with your questions!

Rich Lester

Chief Executive Officer,

Ackerman Group

Gary Ackerman

Founder, and CEO Emeritus,

Ackerman Group

Rich Lester

Chief Executive Officer,

Ackerman Group

Gary Ackerman

Founder, and CEO Emeritus,

Ackerman Group

Executive Summary

- Strong demand for top hospitals: We recently signed an LOI at 16x (two bidders at this level), and Ackerman has closed several deals for A+ hospitals at 14x+, creating an ‘affordability’ issue for some buyers.

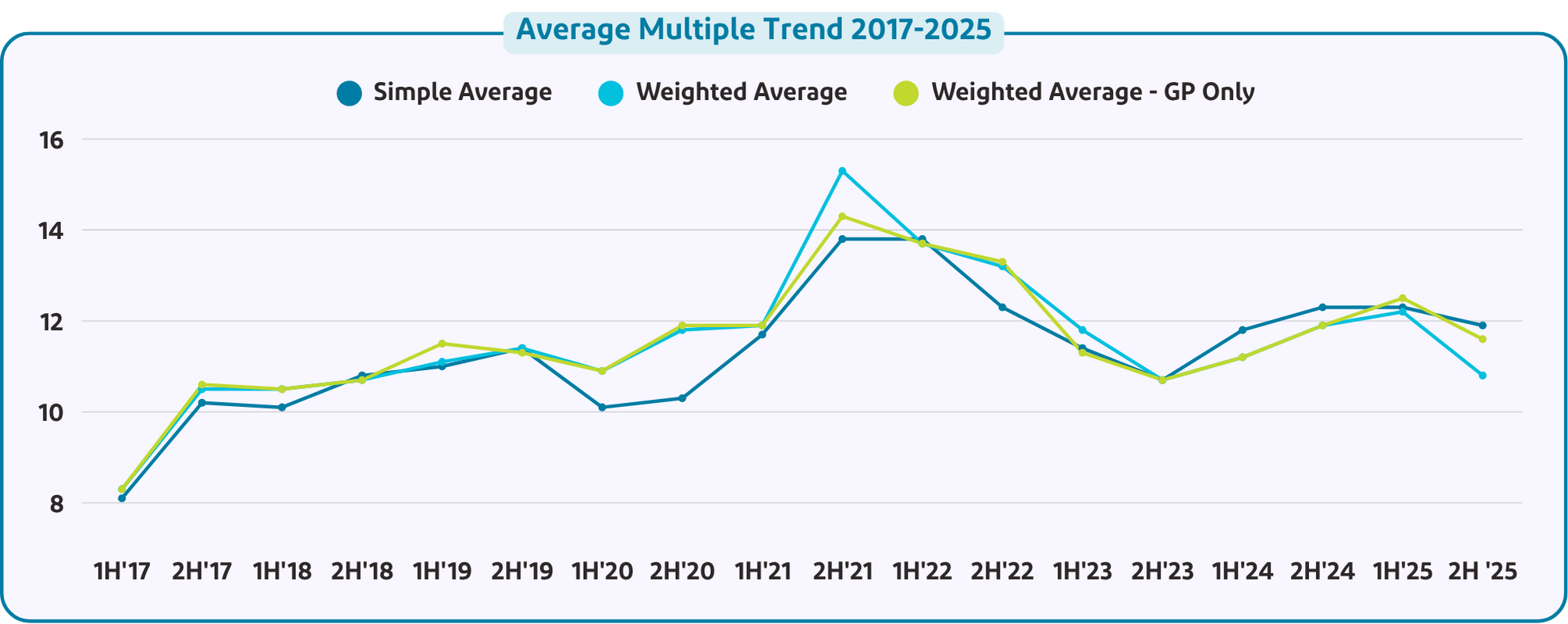

- Purchase Price Multiples were essentially flat in 2H25 at 12.4x, down from the 1H25 peak of 12.5x, for the weighted-average General Practice (GP) multiple.

- Delayed Closings: We have seen deals restructured during diligence if a seller’s revenue growth declined materially during the transaction, which was more frequent in 2025.

- Many Active Buyers continue to drive the market as Ackerman Group sold 50 hospitals in the United States to 15 different buyers in 2025.

- Invoice Counts have declined at least 2% for four straight years – 2022, 2023, 2024, and now 2025, creating real industry headwinds.

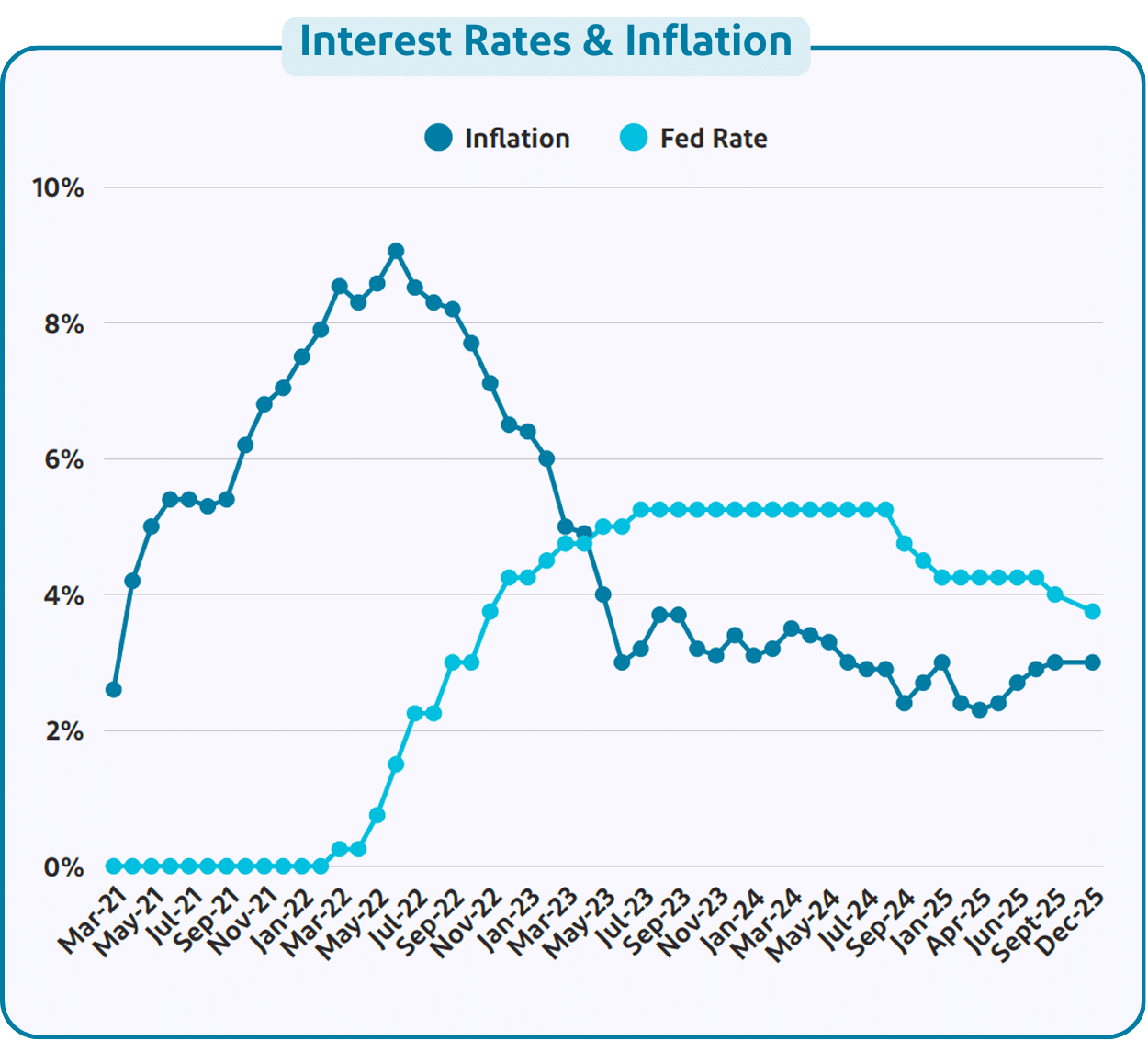

- The Federal Reserve lowered interest rates by 75 basis points across three rate cuts in September, October, and December to stimulate the economy

We will start our year-end review with a look at the U.S. economy, then examine veterinary industry trends, and finally, the market for veterinary practices.

Ackerman Group at a Glance

The Veterinary Professionals Leading Broker

$2.1 B+

In combined value of veterinary practices brokered by our team since 2020.

265+

Veterinarians we have assisted with the sale of their veterinary practices.

75+

Years of collective experience among our Senior Partners in the veterinary industry.

The Current State of the U.S. Economy

Economists have predicted for months that inflation would rise materially due to President Trump’s tariffs, but it has not materialized. Inflation was 3% when DJT took office in January 2025, but fell to 2.7% in November. However, economists are skeptical of the November data because of the impact of the government shutdown. The inflation data was weighted to the end of the month and lower Black Friday pricing. December’s inflation data, released in mid-January, will provide a clearer picture of inflation. The Federal Reserve has cut interest rates three times since September, which President Trump considers not often or fast enough.

Zohran Mamdani won the NYC mayoral race by focusing on solutions to the affordability crisis in NYC. DJT and the Republican Congress do not seem concerned with affordability, as evidenced by the end of the health insurance premium subsidies under Obamacare as of year-end. This will result in millions of Americans seeing healthcare premiums rise 3-4x in 2026.

Years of inflation, recent tariffs, and now rising health insurance premiums are hitting many middle-class and lower-income Americans hard, making ‘affordability’ the new hot political topic for the Democrats.

The challenge for the Federal Reserve is balancing the need to boost economic and job growth by lowering interest rates while also contending with rising costs (inflation).

Unaffordability Impacts Veterinary Industry Growth

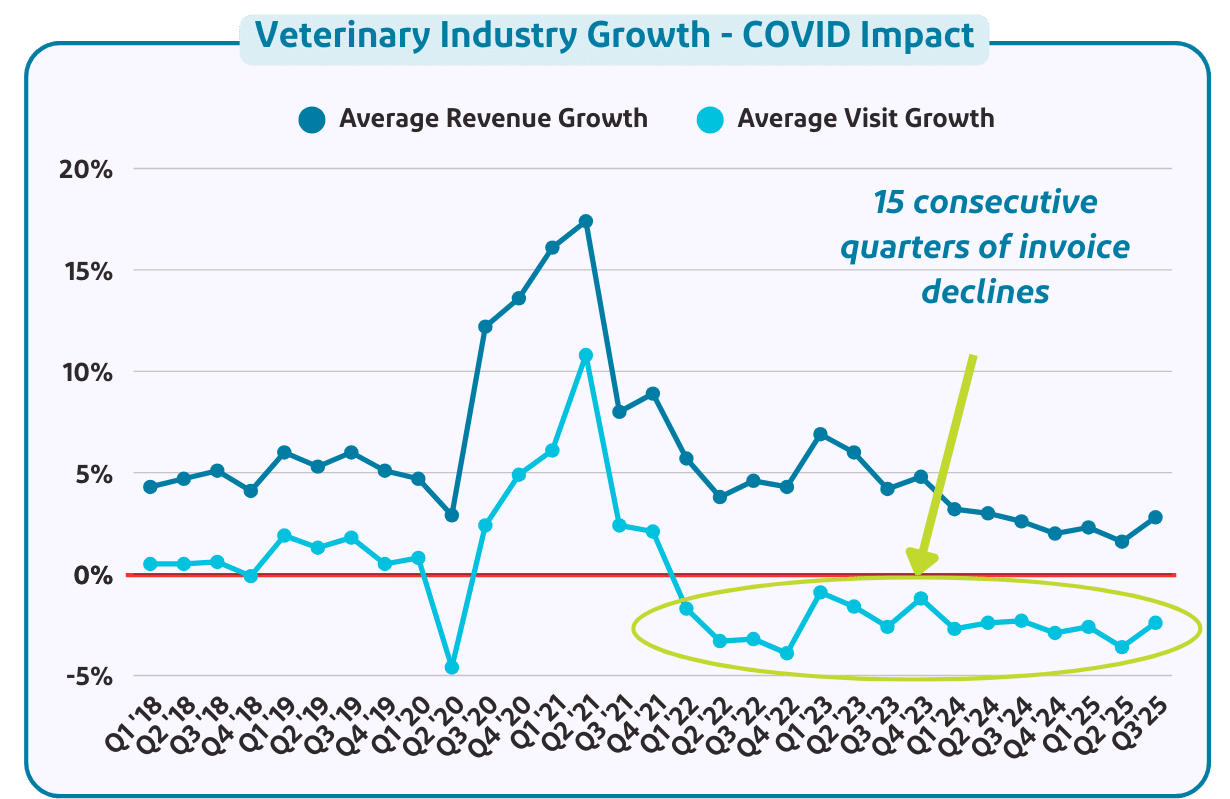

The veterinary industry continues to face strong headwinds, with invoice declines persisting. The lack of consumer confidence in the economy is likely going to continue this trend.

The chart below, based on IDEXX data, shows that invoice growth remains negative, with the industry now experiencing 15 consecutive quarters of declines. Declines in Q3 2025 abated somewhat from the Q2 2025 trough, which was the worst quarter in 4 years. This unprecedented negative trend for veterinary practices is likely caused by:

What is causing the decline?

- Practices raised prices aggressively in 2020/2021 when demand was insatiable, and these price increases have created an affordability issue for pet parents.

- COVID puppies and kittens have become adults, who tend to visit clinics less frequently.

- The affordability crisis people feel in their daily lives, driven by tariffs, rising health insurance premiums, and more, is potentially impacting veterinary spend for some.

What is causing the decline?

- Practices raised prices aggressively in 2020/2021 when demand was insatiable and these price increases have likely impacted clients’ willingness to visit.

- COVID puppies and kittens have become adults, which tend to visit clinics less frequently (until they become seniors).

- Economic uncertainty is making consumers more cautious.

Is the invoice decline a cyclical downturn that will revert back to the predictable ~1% invoice growth of the 2010s?

It was the stable, predictable invoice growth in the 2010s that brought the massive influx of investment capital into the industry and drove purchase prices for veterinary practices to today’s 8-15x EBITDA from pre-2017 levels of 4-6x.

Is the invoice decline a cyclical downturn that will revert back to the predictable ~1% invoice growth of the 2010s?

What does this mean for practice owners?

The concern is that if invoice growth is negative for a 5th year in a row (2026), investors may start to view it as a fundamental industry issue (not a cyclical correction), leading to lower valuations for hospitals. It hasn’t happened yet!

Valuations have remained strong despite these headwinds, and we know investors are counting on above-average invoice growth starting in 2027-28 as COVID puppies and kittens become seniors (over 7 years old), likely requiring more visits.

Are Headwinds Finally Impacting Valuation?

We are seeing strong valuations being driven by a handful of buyers that are confident in their ability to drive revenue and profit growth post-closing. This proven success allows some buyers to pay rich valuations when they can confidently predict post-closing Year 1 and 2 profit growth, lowering their ‘effective’ multiple. Having several buyers with this post-closing confidence has been essential to maintaining high multiples.

The economic rationale for high valuations remains weak, but individual buyer reasoning remains strong. It feels like a “tiering” of buyers is developing based on each group’s success or lack thereof in confidently driving post-closing success. Know that there are buyers who have had success growing practices but remain more disciplined, and these buyers aren’t yet paying the multiples others are willing to.

Note that we focus on weighted average GP multiples because Ackerman sold some successful single-specialty hospitals, which bring down the overall weighted average multiple due to high key person risk.

- There is insatiable demand for large practices in strong demographics, with multiples of 13.5-16x being paid for top performers with at least 4 DVMs and $700,000 of EBITDA.

- Hospital performance matters during the sale and due diligence process. If a seller falters in a material way, the valuation could be ‘re-traded’ to a lower price or structure.

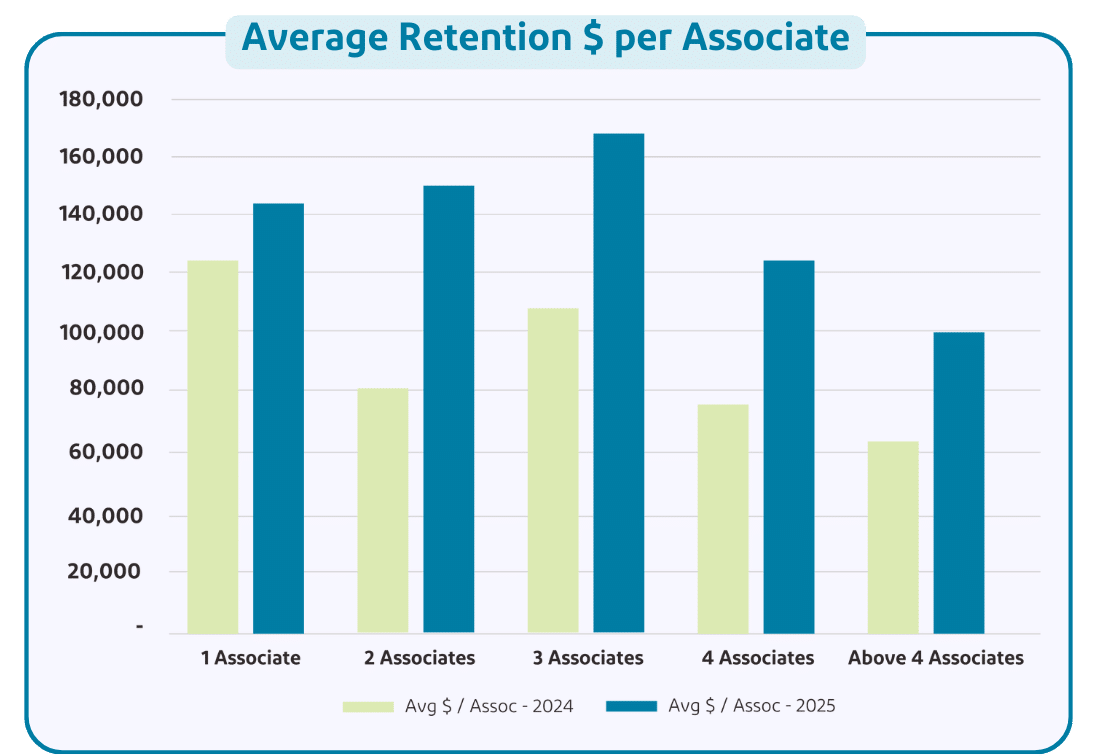

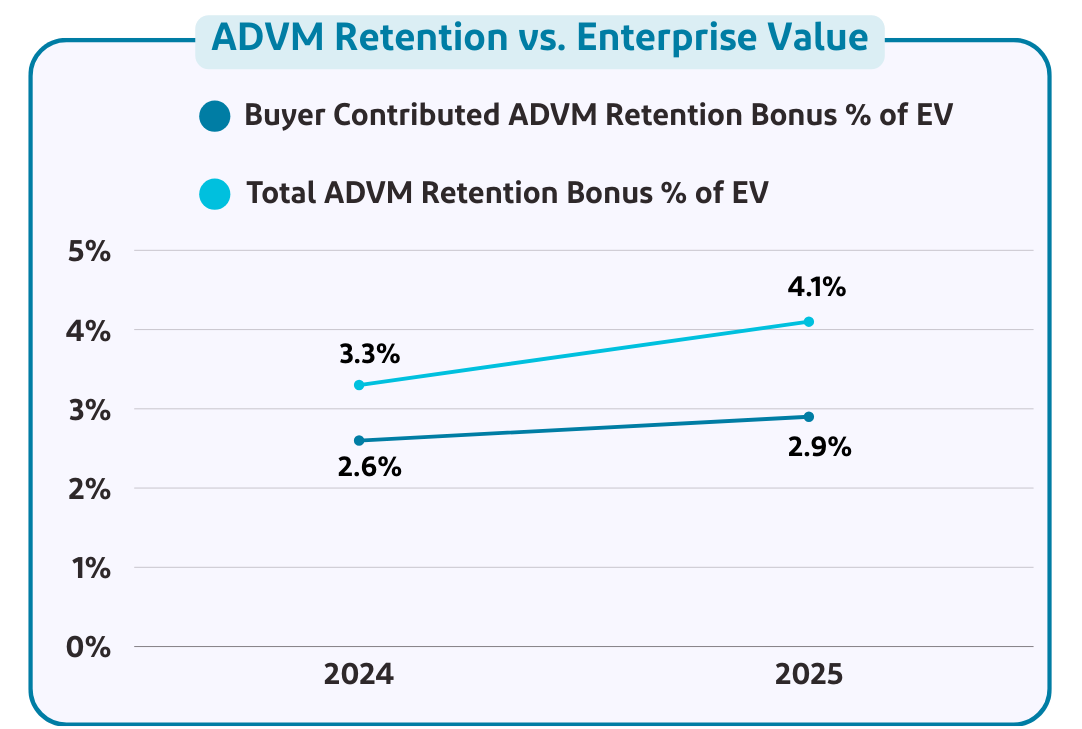

DVM Retention Remains Critical

- Per-Associate retention incentives grew 55% from 2024 to 2025.

- At larger practices with 4 or more Associates, incentives per Associate decline as each Associate becomes less critical.

- For practices with 1-3 Associates, the average per-Associate amount is over $140,000.

Associates are learning that they are essential to these deals and are negotiating for higher incentives to secure multi-year contracts with buyers after closing.

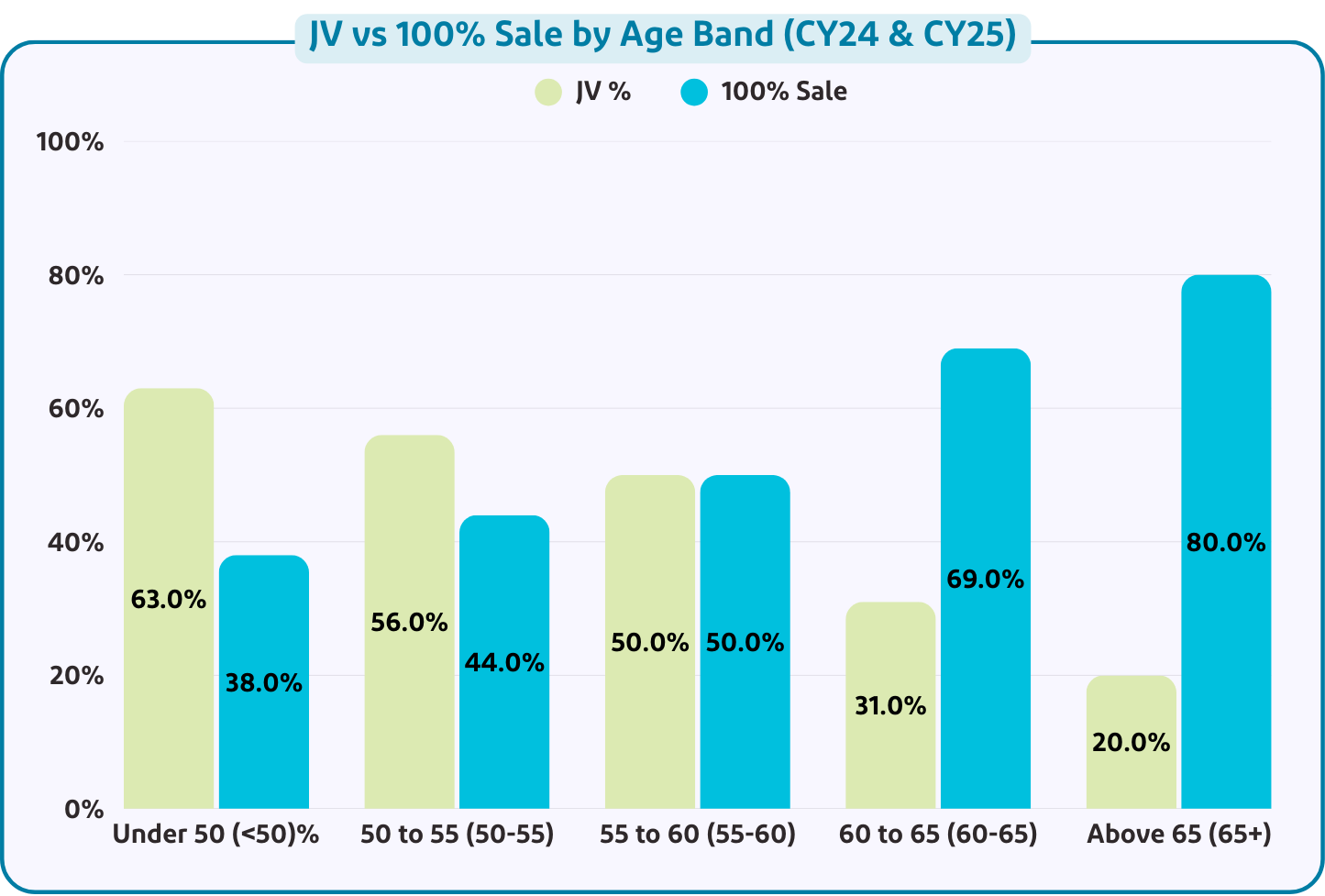

Seller Age Drives Deal Structure

We are seeing Joint Ventures (JVs) become more common as buyers seek to more directly align incentives with the seller and, potentially, Associates who buy in. To drive returns, buyers want JV partners to commit to 4-5 years, which has led more younger sellers to pursue this structure. A few years ago, a 3-year JV commitment was offered, and we see that less frequently today.

Nearly 50% of Ackerman transactions in 2025 involve JVs. The graph highlights that the share of joint venture transactions is over 60% for those under 50 and 55% for those 50-55 years old and diminishes for older sellers.

The Dormant Recap Market Showed Signs of Life in Late 2024:

Will it Reinvigorate in 2026?

The large veterinary consolidator recapitalization market (in which a new investor buys out existing investors) has been dormant since mid-2022, when Vetcor and Peoples Pets & Vets merged. The merger of Southern Veterinary Partners (SVP) and Mission Veterinary Partners (MVP), which closed in December 2024, was the first significant recapitalization in 2.5 years and led to the creation of the newly branded Mission Pet Health (MPH).

The MPH deal closed at a reasonable valuation – 17–18x EBITDA. However, we are now over 12 months past that deal’s close, and there have been no subsequent successful recapitalizations. Several mid-sized and large consolidators tested the market in 2025 but could not secure valuations that satisfied their investors. Interest rate cuts could reinvigorate this market in 2026.

Private equity buyers have become better at distinguishing strong from average corporate groups and are unwilling to pay premium prices for average performers, resulting in fewer successful recapitalizations. We will likely continue to see the market ‘tier’ among strong performers, those that need to improve, and those that are changing leadership to drive better performance. This “tiering effect” ties back to the earlier assessment that specific buyers are willing to bid up A+ practices because they have confidence in their post-closing ability to drive material revenue and profit growth. We believe private equity investors understand these dynamics and value consolidators accordingly

We will closely monitor trends in the recapitalization market, and if those deals occur at lower multiples, it could lead to lower multiples for individual hospitals. However, as long as several buyers remain confident in their post-closing performance, valuations should remain elevated.

“3 Legs of the Stool”

When we talk to owners about the ‘optimal’ time to consider a sale, we walk through the 3 Legs of a Stool:

- Individual Owner: Are you ready to sell, emotionally and financially?

- Practice: Is the hospital in a good position with doctor staffing and profitability?

- Market: Is the market strong or at least good enough in terms of valuations to achieve your financial goals?

Real Owners. Real Opinions.

![]()

“By ourselves, we had previously received an offer from NVA that seemed low to us. With the sale, JV earnings, and earnouts achieved, we ended up making 17 million more than that initial offer. I know we hear comments about the commission rate on sales, but look what we achieved with it! We can absolutely state that the commission price was money well invested.”

![]()

“I’ve been in the banking world for almost 30 years, so I was familiar with the processes [of selling] and was fearful of what I was getting myself into. Ackerman Group made it more seamless than I anticipated.”

Summary

As always, time will tell but we reiterate our advice of – IF you are planning to sell in the next two years, start now to mitigate the industry downside risk.

Thank you for reading!

Questions? Reach out to our team of advisors:

3 of 100

3 of 100

Confidential, No-Cost Valuations

Available for veterinary practices generating over $1.2M in annual revenue.

Unbiased, Data-Driven Estimates

Powered by our proprietary valuation database and extensive industry benchmarks.

Actionable Insights to Improve Profitability

Every valuation includes expert recommendations based on a detailed financial review.