Each quarter, public companies are required to formally report their performance to investors. In tandem, they frequently host a conference call with investment analysts to dive into the details. The folks at IDEXX did both earlier this week, and while Wall Street always pays close attention, we feel it’s important that practice owners do too.

Why? Not because of how many SediVues were sold in the last three months, but because every quarter IDEXX discusses visit trends at practices across the country. We read the report and listened to the call, so you don’t have to, and this is what is worth noting.

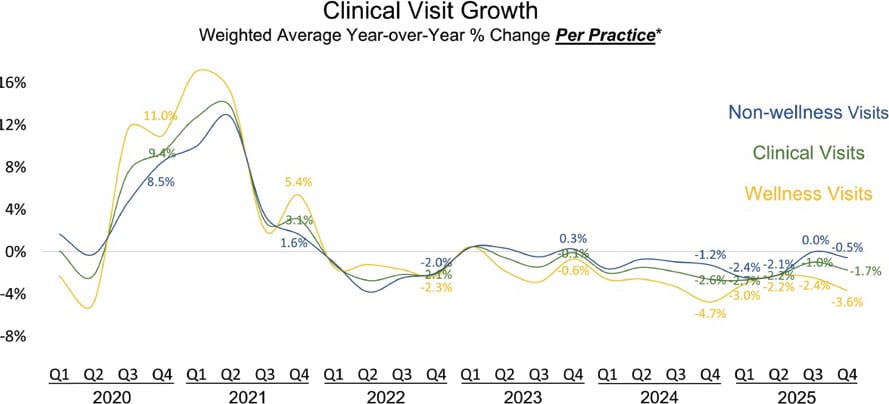

The Headline Numbers:

- Total Visits: -2.8%

- Clinical Visits: -1.7%

- IDEXX defines these as visits that involve an interaction between a clinician and a pet.

- Non-Clinical Visits: Not disclosed, but mathematically needs to be a lot more than -2.8%

- Based on IDEXX’s definitions, these would be things like product pickup, boarding/grooming, nail trims, etc.

- Wellness Visits: -3.6%

- Non-Wellness Visits: -0.5%

What’s the Trend Behind the Trend?

It’s not pretty. This marks the 16th straight quarter – so, four years(!) – of negative “growth” for all of the aforementioned metrics. We’ve talked a lot in our quarterly reports about the consequences of this pattern as it pertains to consolidation and practice valuations. The bad news is that IDEXX’s current CEO, Jay Mazelsky, indicated that they expect Clinical Visits to be roughly -2% for 2026 too.

Source: IDEXX Q4 Earnings Snapshot

Reading Between the Lines

My opinion for nearly two years now has been that the US economy is deceptively weak. While affluent consumers have been spending money like it’s going out of style (see American Express’s recent quarterly commentary for validation of this), everyone else is tightening their belts and not spending unless it feels necessary. For pet owners, this means that annual preventative care, when Fido looks spry and healthy, can probably wait, but if Fido is vomiting, limping, or has a weird lump then we’re making an appointment to see you ASAP.

IDEXX’s reporting generally supports this continuing thesis. While they promote the concept that non-wellness visits are close to flat due to pandemic pets getting older and needing more care, I’m not sure that portion of the total pet population alone could move an otherwise negative needle back to even.

Additionally, while they neither report on or talk about non-clinical visits, those have to be quite negative and generally account for the most discretionary type of spend at a practice. Anecdotally, we’ve heard from practice owners that boarding and grooming is a challenging business in a lot of areas. Highly established daycares seem to be weathering the storm as work-from-home remains very commonplace and consumers who historically have relied on this service are more affluent. Non-clinical visits would also be the category where we’d see the measurable effects of product sales shifting out-of-practice to online platforms like Chewy.

What You Should Do

While the sky isn’t falling, it is still cloudy in vet, with IDEXX’s forecast of more overcast skies throughout the year. If you are a practice owner feeling these effects of negative visit trends, there are several practical, actionable tactics to focus on:

- Optimize your wellness reminders – yes, I recognize how “boring” reminders are, but they are quite literally the most controllable “action” a practice can take to drive visits. I’m not one to shamelessly plug, but I’ll be presenting a session on the topic at WVC in several weeks.

- Don’t be passive on vomiting/diarrhea cases – some reception teams, during the height of the DVM shortage, became accustomed to referring less critical sick cases to urgent cares when their doctor schedules were full. Now, with appointment books more open, those pets should be coming in to see you.

- Invest in AdWords (aka Google Ads) – during tougher times, small businesses tend to retrench and pull back on marketing spending. This is a massive miss as now is exactly the time to be focusing on maximizing visits. Until someone proves me wrong with a broad, trended dataset, I will continue to advocate that Google AdWords campaigns remain the cleanest path to new client growth at small animal practices. Forget diner placemat ads, sponsoring the tee ball team, and printed phone book listings – those do not perform at 99% of practices.

I recognize that none of those are groundbreaking, but they are strategies that continue to perform well and are frequently overlooked as too basic, too easy, or already done.

Looking Forward

Next quarter, IDEXX will tell investors how well they’re doing again. We’ll keep watching the real nugget: what those visit patterns mean for your practice—and how you can adapt.

Full Overview

Written by:

Win Lippincott works with veterinary practice owners on the decisions that shape their practices—both today and down the road. Much of his work involves helping owners strengthen performance, improve decision-making, and build healthier, more valuable businesses long before a sale is even considered.

When owners do begin thinking about a transition, Win helps them understand valuation, buyer behavior, and what actually matters in a sale process. His perspective comes from working side by side with owners and seeing how practices evolve over time, not just from observing transactions at the finish line.

He writes to make complex topics easier to understand, so owners can focus on running better practices now and making confident, informed decisions when the time comes. You can find him presenting on stage or walking the floor at VMX, WVC, AAHA Con, Insightful.vet, etc.

Win welcomes thoughtful questions and conversations—connect on LinkedIn or reach out through the Ackerman Group contact page.