What are the benefits of deferring your taxes in your veterinary practice sale?

If you sell your entire business for cash, you’ll pay the government their cut first, then you’re left with about 65-80% of the total proceeds to invest and fund your retirement or lifestyle. But if you weave some of the common tax deferral strategies into your deal, you can let a chunk of that pre-tax money grow for a few years before you receive the cash and have to pay taxes on it.

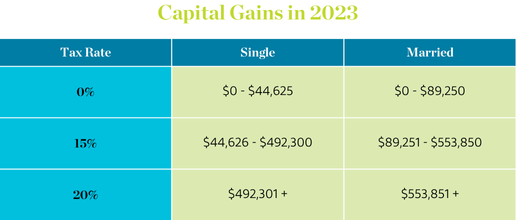

A major advantage of delaying your tax payments to future years is the graduated federal capital gains rate: the more you earn, the higher the capital gains tax rate increases. In 2025, for those married or filing jointly, the first $96,700 of capital gains is tax-free; from $96,701 to $600,050, the rate is 15 percent; and anything above $600,051 is taxed at 20 percent. By deferring your payments over multiple years, you can benefit from lower capital gains rates each year based on your income.

So when considering tax deferral, ask yourself: With the tax deferral structure used in a deal, could there be a potentially better return on the capital that has been deferred?

The four most common tax deferral options in vet practice deal structures

There are four common deal structure approaches that result in tax deferrals. They are:

1. Notes

2. TopCo (or Parent Company) Equity

3. Retained Joint Venture Ownership

4. Earnouts

In each of these scenarios, a portion of the purchase price isn’t paid at closing. Instead, it’s paid in future years, which delays your tax burden until you receive the cash in those subsequent years.

1. Notes

Notes give you a lot of flexibility and control over when you get your cash. Most buyers are willing to spread out their purchase price payments over future years, and they usually provide an interest payment of about 4-9 percent on any notes they issue. As a seller, for example, you can arrange to get a note that pays you $500,000 every year for 3 to 5 years. This setup can help cut down your capital gains taxes on that portion of the sale proceeds, assuming the tax codes stay the same.

A Seller Note is a method of financing buyers use to cover the difference between the selling price of the vet practice and the amount the buyer is able to pay.

2. TopCo or Parent Company Equity

Over the past number of years, TopCo equity has become a popular option in veterinary transactions, with many buyers encouraging sellers to roll over a portion of their sales proceeds into ownership in the buyer’s business. Typically, sellers receive 10-30 percent of the purchase price as TopCo equity. This equity portion isn’t taxed until the buyer decides to sell or recapitalize.

From a tax perspective, rolling over into TopCo equity means no taxes are due at closing on this portion of the sales proceeds (you do pay taxes on the cash you receive). However, sellers lose control over when this equity will be converted back into cash, as it depends on future recapitalization or sale events. While this structure offers a tax deferral advantage, the timing of returns can vary and is influenced by many factors. Historically, returns on this kind of investment have been above average. It’s worth noting that 20-35% of your equity investment represents the taxes you would have paid if you had taken a cash sale instead—essentially, you could have $75 in cash after taxes or $100 in TopCo equity.

3. Retained Joint Venture Ownership

In a joint venture setup, the seller keeps a 20-40 percent stake in their individual hospital(s)—this is different from TopCo equity, where you own part of the overall parent company. Here, you receive cash for 60-80 percent of your veterinary practice and pay taxes on that amount. The equity you keep in the hospital isn’t taxed until you decide to sell it, which can be spread over several years.

Case Study:

Dr. Jason & Joann Randall

-

Transformed a challenging sale into a strategic, high-value deal

-

Maximized practice worth while ensuring a smooth staff transition

-

Gained financial freedom and flexibility for the next chapter

This scenario lets you sell off your stake bit by bit, taking advantage of lower capital gains tax rates for gains under $500,000, or you can choose to sell it all in one go. This way, you have more control over when and how you sell your retained interest. Plus, one advantage of joint venture ownership is getting quarterly cash distributions based on the practice’s profits, something you don’t get with TopCo equity since that money goes back into buying more practices. The quarterly distributions are taxed as ordinary income.

4. Earnouts

For some practices, buyers structure earnouts or contingent payments that depend on the practice’s performance in the first twelve to twenty-four months after the sale. It’s important to ensure that these payments are structured as part of the purchase price and therefore treated as capital gains. Typically, these payments are made one or two years after closing, serving as a tax deferral strategy. This approach is particularly relevant for rapidly growing practices, as it allows sellers to potentially capture additional sale price based on future growth.

Cutting down on taxes: the importance of advanced planning

As you think about selling your practice, it’s key to understand how the financial details of the deal will affect your retirement plans. It’s not just about knowing what your practice is worth; it’s equally important to figure out how to minimize your tax burden to keep more cash in your pocket. We strongly encourage all our clients to get a tax estimate from their CPA to really understand what the sale means for their finances and to plan properly. It’s a good idea to talk over these tax strategies with your advisors—Ackerman Group, along with your accountant and financial advisor. This way, you’ll know all your options and can make sure you have enough money after taxes to live the lifestyle you want. To explore the best strategies for your situation and discuss your veterinary practice sale, chat with the experts at Ackerman Group or contact us today.

Get an accurate estimate of your practice’s value.