Veterinary Practice Appraisals vs. Veterinary Practice Valuations

In some situations, veterinary practice appraisals yield values that are significantly lower than what a corporate buyer might offer for the practice. Appraisals evaluate the cash flow produced by the practice and determine the level of debt that a veterinary buyer could reasonably secure from a bank based on that cash flow (excluding any growth potential).

Usually, appraisal results fall between 4-6 times cash flow or EBITDA. Now, this valuation result might be reasonable for a smaller practice with 1 to 1.5 doctors, which wouldn’t typically attract a corporate buyer. However, for larger practices with more than three veterinarians and revenues exceeding $1.5 million, this appraised value may be selling the practice short, as it’s often seen as less than what a corporate buyer would be willing to pay.

Appraised vs. Market Value

Appraised Value

- Assigned by a professional appraiser

- Fixed (at a specific point in time)

- “What is the practice worth?”

Market Value

- Assigned by buyers

- Variable (market + economic conditions)

- “What is the buyer willing to pay?”

Important Questions to Consider

I have a larger veterinary practice and plan to sell to a corporate buyer.

If your practice generates over $1.5 million in revenue, employs more than three veterinarians, and you’re planning to sell to a corporate buyer, there’s really no need to pay for an appraisal. Whether you decide to sell the practice on your own (which comes with its risks) or through a broker/advisor (often the best choice), the market will determine the valuation for you. Plus, you’ll save over $5,000 by skipping the appraisal.

I have a larger veterinary practice and plan to sell a portion of the business to an Associate Veterinarian.

In this scenario, the owner is trying to retain a strong Associate DVM long-term by offering them a chance to buy into the practice. The most sensible approach here is to pay for an appraisal to establish a fair value, rather than negotiating the price directly with the Associate. Keep in mind: an appraisal will likely yield a lower value than what a corporate buyer would offer. However, the objective in this case isn’t to maximize the sale price, but to ensure the practice’s stability.

I have a smaller vet practice and plan to sell to a veterinarian.

In situations where neither party in a transaction fully understands how to determine the fair market value, getting an appraisal is absolutely warranted and necessary. An appraisal can establish a more rational price than what might be reached through direct negotiations between the buyer and DVM seller.

Should I Pay for a Veterinary Practice Appraisal?

Ask yourself these two key questions:

- Do I want a corporate consolidator valuation level as the result? If you do, then do not pay for an appraisal.

- Do I want to sell all or a portion of the practice to an Associate veterinarian? If you do, then pay for an appraisal.

There may be other situations outside of the cases laid out here where an appraisal proves useful. We recommend treating the above examples as a useful guide to assess those more unique scenarios.

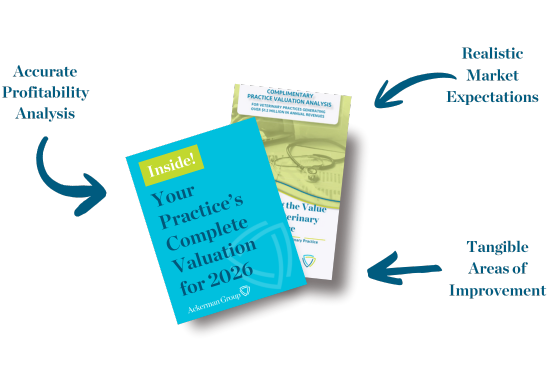

If you fit into the first case example, where you own a larger-size practice and plan to sell to corporate, a practice valuation can give you an accurate reading of your practice’s price tag in today’s market. Ackerman Group offers complimentary and confidential practice valuations.

Get an accurate estimate of your practice’s value.